Bank of America Corp. said it won’t cut any jobs this year as a result of the coronavirus, and is helping clients affected by the pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

The Charlotte, N.C.-based lender has hired 2,000 people this month and is shifting more than 3,000 employees to new roles in its consumer and small-business divisions to deal with the crisis, according to a company memo seen by Bloomberg. The moves include internal and external hires.

“We don’t want our teammates to worry about their jobs during a time like this,” Chairman and CEO Brian Moynihan said in a CNBC interview Friday. “And we’ll continue to pay everybody, even those who can’t work from home.”

Bank of America joins U.S. lenders Citigroup, Wells Fargo and Morgan Stanley, along with European counterparts including HSBC Holdings, in pledging to preserve jobs amid the widespread impact of the coronavirus. The banks are seeking to reassure their employees as the pandemic roils markets and raises the prospect of deep losses industrywide.

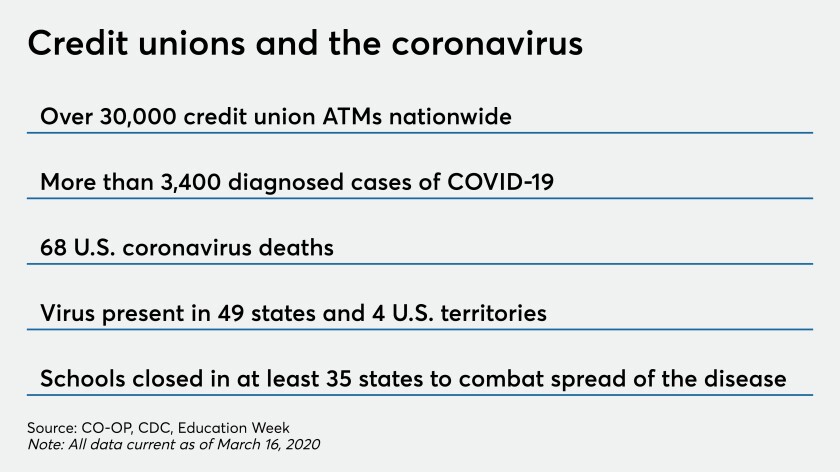

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

Financial institutions’ legislative agenda was already a low priority in Congress. Lawmakers’ efforts to stabilize the economy have shifted attention even farther away from bills that would benefit the industry.

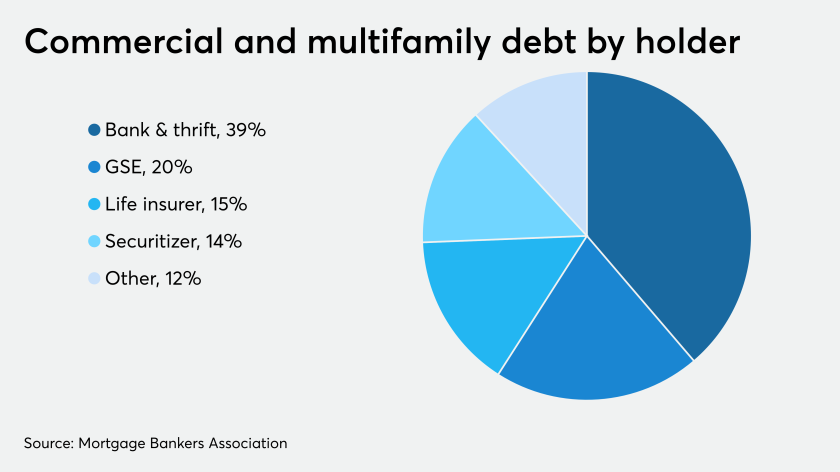

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

Bank of America has extended more than $50 billion in loans to commercial clients this month so they can build up cash and pay employees, according to Moynihan.

“We’ve put our capital to work to increase the new lines of credit, the draws in lines of credit, the access to markets,” he said.

Other takeaways from the interview:

- “We’re going to make sure we maintain strong capital ratios and strong liquidity right through this crisis,” Moynihan said.

- The nation’s top 40 banks are all waiting for the implementation of government assistance programs.

- Bank of America has “a limited number of cases” of the virus among staff members.

- About 150,000 of the company’s 208,000 employees are working from home, and it boosted the number of staffers who have compter monitors at home to 50,000 from 10,000 in five weeks.