Sales of previously owned homes surged in February to the fastest pace in 13 years, highlighting a flurry of activity in the housing market before the economic repercussions of the coronavirus.

Contract closings jumped 6.5% from the prior month to a 5.77 million annual rate, according to National Association of Realtors data released Friday. The pace exceeded all forecasts in a Bloomberg survey of economists. The median estimate was 5.51 million.

While robust hiring, steady wage gains and low mortgage rates combined to power the housing market last month, the novel coronavirus will undoubtedly spoil that progress. Job losses have become widespread as more businesses shutter and social distancing efforts will diminish homebuyer interest.

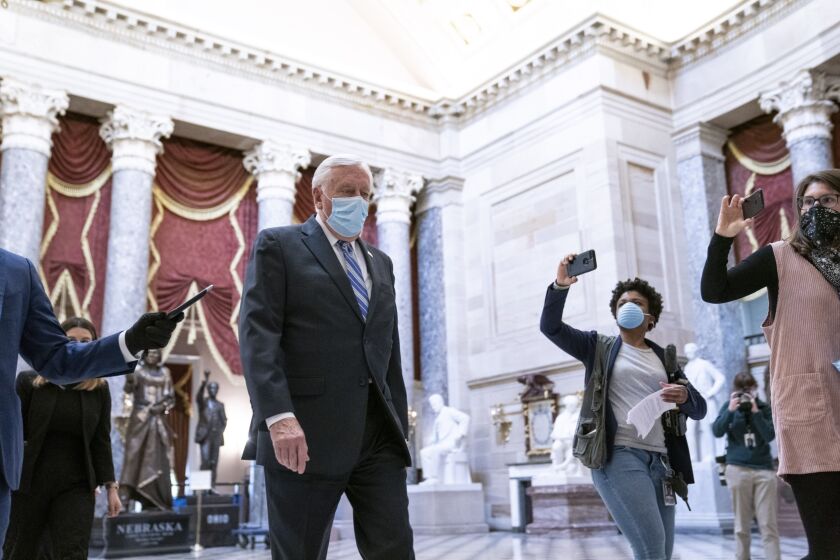

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

The proposal would give a safe harbor to financial institutions that work with cannabis companies in states where the substance is legal. But the bill, which would direct $3 trillion in aid to struggling households, businesses and local governments, faces long odds in the Republican-controlled Senate.

The median sales price increased 8% in February from a year earlier to $270,100 as housing inventory declined on the heels of steady demand.

Sales climbed 18.9% in the West to an annualized 1.26 million units and advanced 7.2% in the South, the nation’s largest region, to 2.52 million.

Some 1.47 million homes were for sale last month, 9.8% fewer than a year earlier. At the current pace, it would take 3.1 months to sell all the homes on the market, near the lowest in more than two decades of data. Realtors see anything below five months of supply as a sign of a tight market.

"February is looking at the rear-view mirror," Lawrence Yun, NAR's chief economist, said on a call with reporters. So far in March, "we are seeing a decline in buyer traffic; some homes are actually getting delisted."

Single-family home sales increased to a 5.17 million pace from 4.82 million.

Existing-home sales account for about 90% of U.S. housing and are calculated when a contract closes. New-home sales, which make up the remainder, are counted when contracts are signed and will be released Tuesday.