Two bank lobbying organizations asked Congress on Tuesday to automatically forgive small-business loans of less than $150,000 that are made under the Paycheck Protection Program.

The request comes as the Senate eyes potential changes to the massive emergency relief effort. Last week, the House of Representatives passed legislation that would make it easier for small businesses to get their PPP loans forgiven. One of its provisions would extend the period of time in which companies must use the funds in order to qualify for forgiveness.

The Consumer Bankers Association and the Bank Policy Institute, both of which represent big banks, want Congress to go further. In a letter Thursday to Sen. Marco Rubio, R-Fla., and other key lawmakers, they argued that blanket forgiveness of small loans would save recipients substantial time and money.

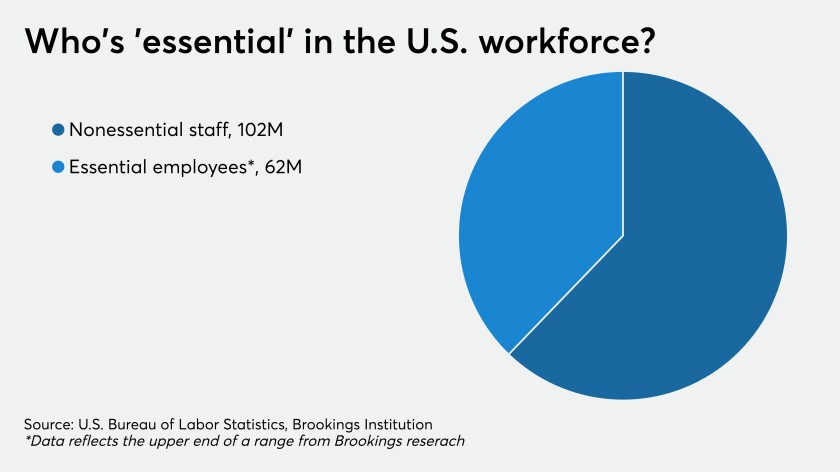

Under a $150,000 threshold, some 26% of all PPP loan dollars would qualify for automatic forgiveness, according to the banking trade groups. But 85% of PPP loan recipients would benefit.

“Their time and resources would be better focused on getting the economy safely back up and running, not processing burdensome paperwork,” the banking trade groups wrote.

Despite limiting branch access and embracing social distancing, member-facing employees at some institutions have contracted COVID-19, and those few could be the tip of the iceberg.

Credit card chargebacks were rising in certain categories prior to the coronavirus outbreak, but the pandemic is causing a spike in all types of payment card disputes.

As the market deals with the short-term challenge of getting trillions of dollars of relief and stimulus payments into the hands of citizens in the coming weeks and months, we as a country have a unique opportunity to put our unbanked and underbanked citizens on a long-term path to electronic payment methods, says FIS' Jim Johnson.

Blanket loan forgiveness would also help banks. Under the program’s current rules, loans to borrowers who fall short of the standards necessary for forgiveness may remain on banks’ balance sheets. While those loans are government-guaranteed, they have interest rates of just 1%, and banks would have to spend money to service them.

Loans of less than $50,000 in the Paycheck Protection Program can ultimately be expected to cost banks about $500 million, according to an analysis by the consulting firm AQN Strategies. The banking trade groups cited that analysis in their letter Tuesday.

The Paycheck Protection Program, which was enacted in late March, has made approximately $660 billion available to small businesses affected by the coronavirus pandemic.

Under the program’s existing rules, 75% of loan proceeds must be tied to payroll in order to qualify for forgiveness. The House-passed bill would reduce that threshold to 60%.

Senate Majority Leader Mitch McConnnell has reportedly been checking with senators to see if the House bill can get unanimous support in the Senate, which could enable passage as soon as this week.