CFOs are assuming a greater role at their organizations in the midst of the COVID-19 pandemic and are likely to hold onto those greater responsibilities once the pandemic subsides, according to a new report from the Institute of Management Accountants and the Association of Chartered Certified Accountants.

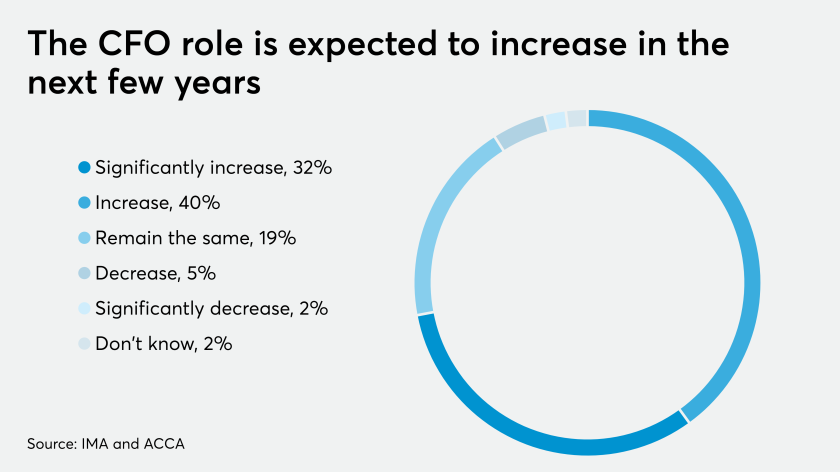

For the report, the IMA and ACCA surveyed 1,152 of their members and found that 72 percent of the respondents believe the role of the CFO will either “increase or increase significantly” in importance. Seventy-eight percent of the respondents indicated that the ethical lens was a differentiating factor for the CFO in comparison to other executives. Meanwhile, 82 percent of the CEO respondents surveyed feel the role of CFO would increase or significantly increase in importance, and 68 percent of CEO respondents say that people highly value the strategic insights of CFOs.

Prof. Johnson is the Ronald A. Kurtz (1954) Professor of Entrepreneurship at the MIT Sloan School of Management. He is also a senior fellow at the Peterson Institute for International Economics in Washington, D.C., a co-founder of BaselineScenario.com (a much cited website on the global economy), a member of the Congressional Budget Office's Panel of Economic Advisers, and a member of the FDIC's Systemic Resolution Advisory Committee. He is also a member of the private sector systemic risk council founded and chaired by Sheila Bair in 2012. Prof. Johnson is a weekly contributor to NYT.com's Economix, is a regular Bloomberg columnist, has a monthly article with Project Syndicate that runs in publications around the world, and has published high impact opinion pieces recently in The Washington Post, The Wall Street Journal, The Atlantic, The New Republic, BusinessWeek and The Financial Times, among other places. In January 2010, he joined The Huffington Post as contributing business editor. Professor Johnson is the co-author, with James Kwak, of 13 Bankers: The Wall Street Takeover and The Next Financial Meltdown, a bestselling assessment of the dangers now posed by the U.S. financial sector (published March 2010) and White House Burning: The Founding Fathers, Our National Debt and Why it Matters to You (April 2012). In his roles as a professor, research fellow and author, Professor Johnson's speaking engagements include paid appearances before various business groups, including financial institutions and other companies, as well before other groups that may have a political agenda. He is not on the board of any company, does not currently serve as a consultant to anyone, and does not work as an expert witness or conduct sponsored research. His investment portfolio comprises cash and broadly diversified mutual funds; he does not trade stocks, bonds, derivatives or other financial products actively. From March 2007 through the end of August 2008, Prof. Johnson was the International Monetary Fund's Economic Counselor (chief economist) and Director of its Research Department. He is a co-director of the NBER Africa Project, and works with nonprofits and think tanks around the world. Johnson holds a B.A. in economics and politics from the University of Oxford, an M.A. in economics from the University of Manchester, and a Ph.D. in economics from MIT. He won the Nobel Prize in Economics in 2024.

Johnny Poulsen is the CEO of Income Lab, a company that wants to revolutionize the way retirement is planned and experienced.

With over two decades of experience in financial services, Poulsen co-founded Income Lab to equip advisors with better tools to help clients retire with clarity and confidence.

Sam Krishnamurthy is the Chief Technology Officer for Turvi.

“This is in a sense a followup study to a joint study we did with the ACCA eight years ago and we had made predictions back then about how the role of the CFO would change,” said IMA vice president of research and policy Raef Lawson. “It was extremely rewarding to see that our predictions were right on. We had predicted that the role of the CFO would be transitioning from financial reporting and stewardship to more of the strategic business partnership role, more engaged through external stakeholders. That’s all taken place. The interesting thing is that the pandemic seems to have just accelerated this change.”

It’s no longer enough for CFOs to simply oversee the finances at the companies where they work. More and more, they’re playing an essential role in the management and governance of their organization. “That entails not only an immediate focus on cash management and cash flow, which are incredibly important during the pandemic, but having a broader engagement in the operations of their organizations and being more involved in the strategy formulation of their organization,” said Lawson. “What we envisioned about the CFO eight years ago is really now essential for organizations. CFOs have a unique perspective of their organizations. They see all the moving parts and help their organizations adjust their strategy and implementation of that strategy, almost on a real-time basis.”

The IMA and ACCA see various ways in which the future role of the CFO seems to be evolving. The CFO may become more focused on stakeholder and investor management rather than safeguarding and reporting. The CFO will likely have a leading responsibility for business strategy formulation, validation, and execution. The focus of the role seems to be shifting from mostly historic-based cost control to growth optimization. The role is likely to encompass measurement of all aspects of the strategic objectives of the organizations. The CFO will provide the greatest value to the organization through forward insight rather than retrospective reporting. According to some respondents, CFOs are increasingly expected to eventually take on the CEO role as the next progression in their career development.

The urgency of the pandemic and the recession it caused have accelerated that increasing role for the CFO, forcing a reexamination of the company’s strategy, risks and business model. It has also forced technological changes such as the need for remote work arrangements.

“Technology is something that we have emphasized a lot at IMA in terms of changing the role of finance in general and the CFO, but this has accelerated the technological transformation of finance,” said Lawson. “We’re all working from home now, or many of us are, learning new technological skills that we probably wouldn't have done otherwise. Not just in terms of working from home skills and communication, but moving to the cloud has become accelerated. We’re all learning new ways to improve our processes to be more efficient, This transformation has been accelerated by the pandemic. The old saying is may you live in interesting times, and COVID has certainly made these times very interesting for CFOs. It’s made the role more challenging, but also made it more essential to the survival and prosperity of their organizations.”

The survey didn’t ask about specific technologies, but it did ask about what priorities were on the CFO’s agenda, and transformative technology was cited as one of the biggest challenges for CFOs. “I think their technological plans probably went out the window or had to be accelerated by the coronavirus,” said Lawson. “It necessitated the introduction of new technologies like Zoom or Microsoft Teams. For many companies, it’s been an adjustment, but those that made the adjustment have seen how more effective and efficient their finance functions are. I think that many businesses won’t go back to business as usual.”

Technical skills are considered to be important, with 54 percent of the survey respondents saying that an accountancy qualification or master’s degree is essential, with 27 percent considering it to be strongly recommended but not essential. Only 2 percent believe neither is needed.

The economy seems to be recovering since the start of the pandemic, but the continuing spread of COVID-19 across the U.S. and other parts of the world leaves many business leaders uncertain about the future.

“The economy is recovering, but it’s going to take time and it looks like there will be bumps in the road in this economic recovery,” said Lawson.

The outcome of the November election is another uncertain factor weighing on the minds of CFOs. “I don’t want to get into politics, but I think the different major parties have different economic agendas and different approaches to handling the pandemic and stopping its spread, so I think the election could have a major impact on the recovery,” said Lawson.

More and more CFOs are getting involved in supply chain issues after experiencing shortages at the start of the pandemic. “One of the interesting results from our current study is that CEOs seem to place more emphasis on the supply chain, which perhaps is due to their broader perspective, but regardless of that, the supply chain is a critical issue as we’ve come to see with the supply chain disruptions brought about by the pandemic,” said Lawson. “CFOs can no longer ignore that part of the business and the risks that supply chain disruptions can bring.”