While the mortgage market began the year healthy, lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

Last month, foreclosure starts fell to the lowest level ever recorded, according to Black Knight. A total of 32,300 foreclosure starts took place in February, down 24.5% month-over-month and 20% from the year before.

The delinquency rate — based on those at least 30 days late on their payment, but not yet in foreclosure — went to 3.28%, inching up from a record low in January, but dropping 15.6% year-over-year. Overall, 1.74 million properties had delinquent loans in February.

As refinances skyrocketed with falling interest rates, February's monthly prepayment rate rose to 1.35%, representing jumps of 7.8% month-to-month and 106.6% year-to-year. March numbers could be indicative of the coronavirus impact.

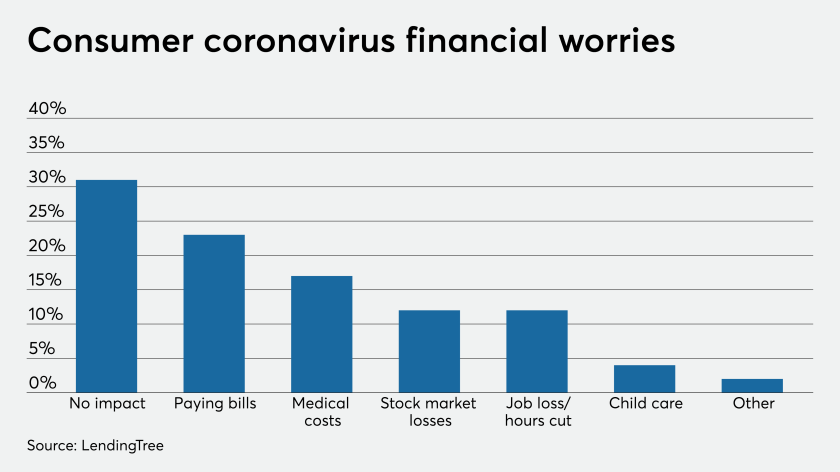

After health concerns related to the pandemic, consumers worry most about their bill-paying capacity, according to a recent LendingTree survey of 1,050 people. Of those anxious about bills, the largest group, totaling 44%, listed rent or mortgage payments as their primary concern. Credit cards, insurance premiums and student loans were next at 23%, 15% and 8%, respectively.

By incentivizing businesses to rehire employees laid off or furloughed due to COVID-19, states will generate a faster economic recovery and provide valuable assistance for companies to get back on their feet.

The Internal Revenue Service and the Treasury Department provided guidance to employers requiring them to report the amount of qualified sick and family leave wages they have paid to their employees under the Families First Coronavirus Response Act on Form W-2.

The Financial Accounting Standards Board released a proposed accounting standards update to help insurance companies adversely affected by the COVID-19 pandemic by giving them an extra year to implement the long-duration insurance accounting standard.

"The changes in consumer behavior will likely lead the U.S. into recession," Tendayi Kapfidze, chief economist at LendingTree, said in a press release. "After an initial boost in consumption due to preparation, spending is set to contract sharply as broad sectors of the consumer economy shut down. Mortgage borrowers can get a break on making their payments via a process known as forbearance."

Fannie Mae and Freddie Mac already announced their plans to suspend foreclosures for at least 60 days, setting a precedent for other lenders during the crisis. Actions will need to be taken to keep borrowers out of delinquency while financial burdens add up.

LendingTree's survey showed 40% of consumers had negative impacts to their pay, through hour reductions, layoffs or missed tips and commissions. That share jumps to 63% when talking about other personal finances like stock losses and supply purchases.