While the mortgage market began the year healthy, lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

Last month, foreclosure starts fell to the lowest level ever recorded, according to Black Knight. A total of 32,300 foreclosure starts took place in February, down 24.5% month-over-month and 20% from the year before.

The delinquency rate — based on those at least 30 days late on their payment, but not yet in foreclosure — went to 3.28%, inching up from a record low in January, but dropping 15.6% year-over-year. Overall, 1.74 million properties had delinquent loans in February.

As refinances skyrocketed with falling interest rates, February's monthly prepayment rate rose to 1.35%, representing jumps of 7.8% month-to-month and 106.6% year-to-year. March numbers could be indicative of the coronavirus impact.

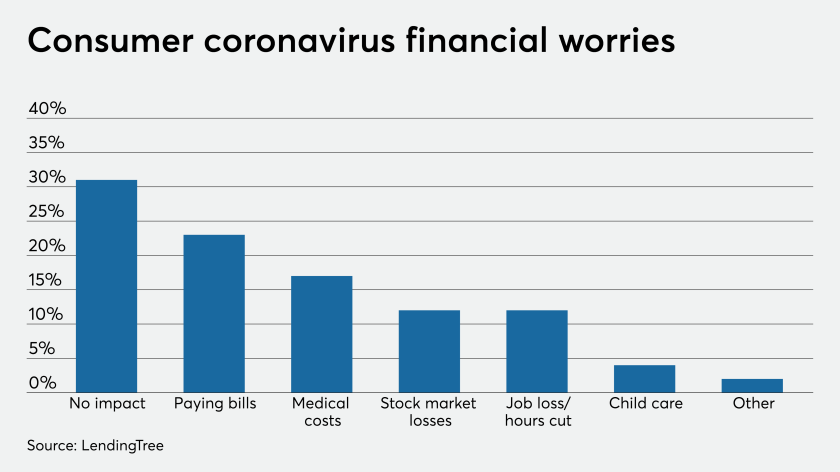

After health concerns related to the pandemic, consumers worry most about their bill-paying capacity, according to a recent LendingTree survey of 1,050 people. Of those anxious about bills, the largest group, totaling 44%, listed rent or mortgage payments as their primary concern. Credit cards, insurance premiums and student loans were next at 23%, 15% and 8%, respectively.

Accounting firms need to become more adaptable in the face of the COVID-19 crisis

Don’t waste the coronavirus crisis: Follow these seven steps to re-evaluate your strategy plan.

The short-term coronavirus response revealed most merchants will need a more robust option for digital payments — and that’s prompting fresh investment in what was expected to be a slow period.

"The changes in consumer behavior will likely lead the U.S. into recession," Tendayi Kapfidze, chief economist at LendingTree, said in a press release. "After an initial boost in consumption due to preparation, spending is set to contract sharply as broad sectors of the consumer economy shut down. Mortgage borrowers can get a break on making their payments via a process known as forbearance."

Fannie Mae and Freddie Mac already announced their plans to suspend foreclosures for at least 60 days, setting a precedent for other lenders during the crisis. Actions will need to be taken to keep borrowers out of delinquency while financial burdens add up.

LendingTree's survey showed 40% of consumers had negative impacts to their pay, through hour reductions, layoffs or missed tips and commissions. That share jumps to 63% when talking about other personal finances like stock losses and supply purchases.