Democrats on the House Ways and Means Oversight Subcommittee are demanding answers from Treasury Secretary Steven Mnuchin about why the Internal Revenue Service suddenly revoked the tax-exempt status of more than 30,000 nonprofit organizations, including nearly 28,000 charities, many of which are in their home states, shortly before the crucial holiday giving season.

They noted that the decision threatens charities that are trying to help Americans struggling through the COVID-19 pandemic and are seeking immediate reversals of those revocations. The IRS typically revokes the tax-exempt status of nonprofits that haven’t filed a Form 990 for three consecutive years, but the lawmakers complained that many of the automatic revocation notices sent by the IRS were erroneous because the service was supposed to grant charities an extension because of the pandemic, and the IRS is still catching up on its unopened mail.

They noted that between May 1 and Oct. 8 of this year there has been a 20 percent increase in the number of charitable organizations that have had their exempt status automatically revoked, compared to the same period last year. The subcommittee members are demanding the IRS stop all other tax-exempt revocations.

The Internal Revenue Service is giving taxpayers until the end of the year before it stops its temporary procedures for faxing in Forms 1045 and 1139 for claiming tentative tax refunds.

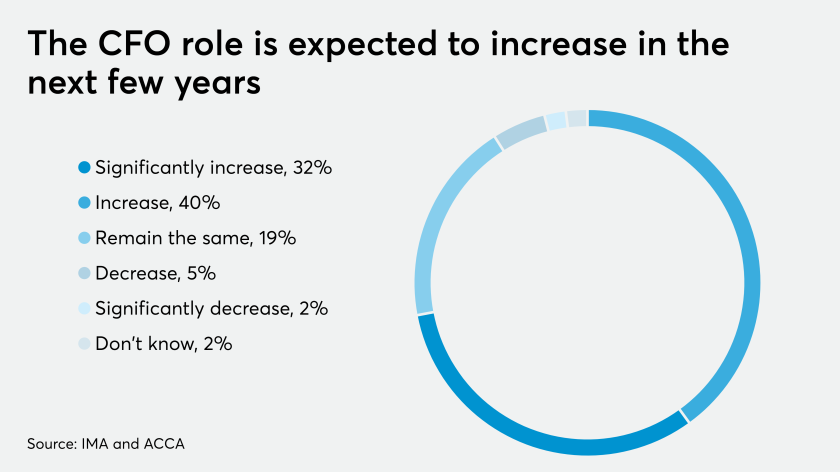

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

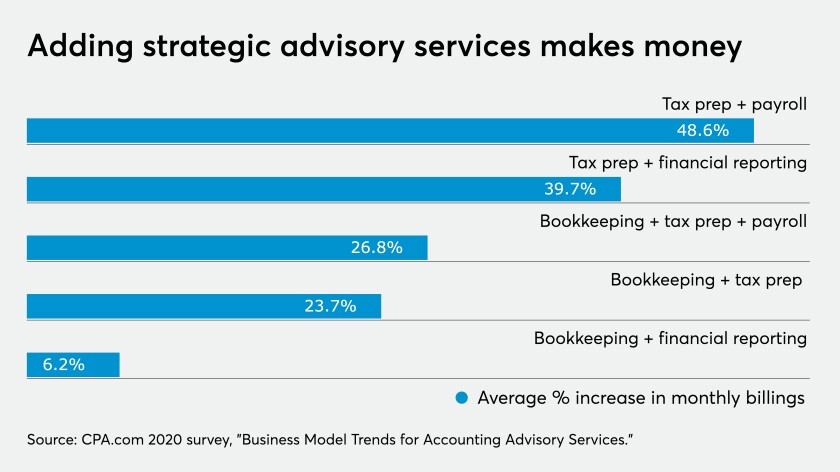

Automated technology makes it easier to provide extra services during these difficult times; and it also creates opportunity to move to value pricing.

“We write today to find out why the Trump administration automatically revoked the tax-exempt status of, and sent erroneous revocation notices to, more than 30,000 nonprofit organizations around the country, including 28,000 charities as we enter the most popular time of year for Americans to make charitable contributions,” said the lawmakers, led by House Ways and Means Oversight Subcommittee Chairman Bill Pascrell, D-New Jersey, in a letter Tuesday to Mnuchin and IRS Commissioner Charles Rettig. “We urge you to investigate this apparent error by the Internal Revenue Service and take corrective action immediately. These organizations do critically important work for our communities — especially during this difficult time for our nation — and we must ensure that the IRS is not wrongfully terminating their exempt status.”

They acknowledged that the IRS automatically revokes the exempt status of organizations that don’t file the required Forms 990 for three years in a row, and the revocation takes effect as of the due date for the filing, which generally is May 15 for calendar-year organizations. However, due to the novel coronavirus pandemic, they noted, the IRS extended the filing date this year to July 15.

“In other words, organizations that would have had their exempt status revoked on May 15, 2020, were given until July 15, 2020, to file and, in doing so, retain their exempt status,” the lawmakers added.

Nevertheless, the IRS revoked the tax-exempt status as of May 15, 2020, despite the extension of the filing date. In total, nearly 31,500 organizations have had their tax-exempt status automatically revoked since May 15, 2020, including 3,800 in California, 1,700 in New York State, 1,000 in Pennsylvania, 900 in New Jersey, 700 in Washington State, and 500 in Wisconsin.

“This raises serious questions as to whether the IRS’s systems properly accounted for the extension of the filing date to July 15 and whether IRS processing and correspondence backlogs may have impacted the receipt of timely-filed Forms 990,” said the lawmakers, who include Pascrell, Rep. Suzan K. DelBene, D-Washington, Linda Sanchez, D-California, Thomas Suozzi, D-New York, Judy Chu, D-California, Gwen Moore, D-Wisconsin, and Brendan F. Boyle, D-Pennsylvania.

The errors may be due to the IRS’s continued efforts to update its systems and catch up with its backlog of millions of pieces of unopened mail that have built up since the start of the pandemic. The lawmakers asked for the IRS to reverse all the erroneous automatic revocations that have occurred during the pandemic and cease further automatic revocations until the IRS has processed its substantial mail backlog. They asked for answers from Mnuchin and the IRS by no later than Tuesday, Oct. 27.

“Please provide the subcommittee a report on this matter, including an explanation as to why May 15, 2020, is listed as the revocation date for many organizations and why automatic revocation notices were sent in August when the IRS has not yet processed millions of pieces of unopened mail,” they wrote. “As part of that report, please also explain how the Department of the Treasury and the IRS will remedy this situation for all affected organizations before the end of the month.”

The IRS said Thursday it will work to correct the automatic revocations. “Due to systemic limitations, we were unable to update this deadline in the program that automatically issues notices of revocation,” said the IRS in an email. “This caused some revocation notices to be issued prematurely. Nevertheless, the IRS prevented eligible organizations that attempted to file electronically by July 15 from being listed as automatically revoked on IRS.gov, where they are still shown as tax exempt. At the same time, we are processing paper filings which allow the reversal of auto-revocation for those filers. The IRS is reviewing the cases and corresponding with organizations that received the premature notice. Additionally, we have dedicated fax number (855) 247-6123 to receive correspondence from organizations in this situation that wish to present documentation of their applicable filings.”

(This article has been updated to include the IRS's response.)