HSBC says it will speed up the U.S. restructuring that it announced just before the pandemic, though the bank did not provide any details Tuesday of its updated cost-cutting plans.

So far this year, HSBC has closed more than 30% of its U.S. branches, and it has reduced its full-time employees by 11%, the bank said. The consolidation plan that HSBC announced in February called for a 30% reduction in U.S. branches and a 15% cut in staffing, with cuts more heavily centered on the East Coast than other parts of the country. HSBC had 224 U.S. branches at the end of last year, mostly in New York, California and Florida.

CEO Noel Quinn said Tuesday that HSBC executives made major progress on U.S. expense reductions during the first nine months of the year.

“But they’re also very cognizant of the fact that the circumstances are more challenging today than they were in February,” he said during a conference call with analysts. “And therefore, they’re looking at ways to accelerate the road to improved returns.”

Quinn said that HSBC will provide additional information about its cost-cutting efforts in February, when it next reports quarterly results.

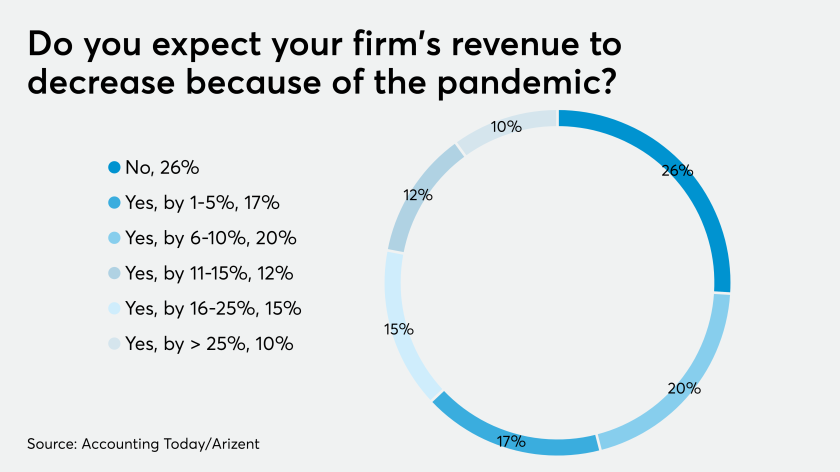

As an accounting professional, these are tough days. But that doesn’t mean your practice can’t grow during this season.

The Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

By incentivizing businesses to rehire employees laid off or furloughed due to COVID-19, states will generate a faster economic recovery and provide valuable assistance for companies to get back on their feet.

The global bank’s U.S. unit reported a net loss of $165 million in the third quarter, after reporting a $104 million profit a year earlier, due largely to higher operating expenses. Loans and advances to U.S. customers fell by 5% to $62.8 billion.

Globally, HSBC reported after-tax profits of $5.2 billion during the third quarter, down from $13.7 billion in the same period last year. The bank revised downward its guidance on expected loan losses for the full year, saying that it now expects losses to be at the lower end of its previously announced range of $8 billion to $13 billion.

HSBC’s announcement of U.S. cost-cutting plans marked a reversal from 2019, when the bank was planning to open as many as 50 branches in new and existing U.S. markets. HSBC said in February that the restructuring would allow it to focus on the needs of the U.S.-based international population as well as consumers who travel overseas.

This is not the first time HSBC has shrunk its U.S. retail network. In 2012 it sold its upstate New York franchise to First Niagara Financial Group in Buffalo, N.Y., which was ultimately sold to KeyCorp in 2016.