The share of borrowers seeking payment relief on loans skyrocketed as COVID-19 concerns mounted, a recent survey by the Mortgage Bankers Association shows.

Between March 2 and April 1, the amount of loans with forbearance requests increased to 2.66% from 0.25%. This marks a more than tenfold growth in requests every two weeks, with a 1,270% increase between March 2 and March 16 and a 1,896% jump between March 16 and March 30.

Hold times in servicer call centers also grew dramatically — from 2 minutes to 17.5 minutes — over the course of a few weeks in March. Abandonment rates increased to 25% from 5%, the report found.

The largest surge in forbearance requests was for the government loans packaged into the securitizations that Ginnie Mae insures, rising from 0.19% to 4.25% over the period analyzed.

Ginnie Mae has promised to provide some support for mortgage servicers that need to advance principal and interest payments from loans to bondholders while borrowers are not paying, but it's unclear how extensive that government intervention will be, and the MBA has sought broader public aid for the industry.

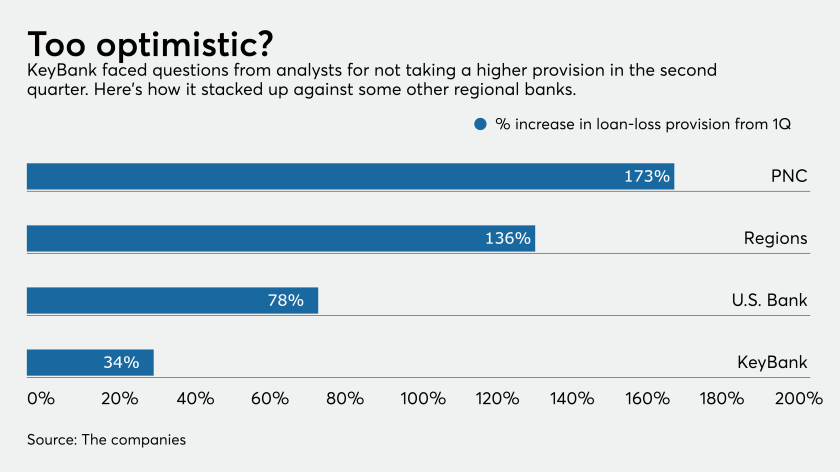

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

Massachusetts Society of CPAs president and CEO Amy Pitter is spearheading a group of 28 state society heads who have sent a letter to congressional leaders.

The Tax Cuts and Jobs Act created opportunity zones as an economic development tool to stimulate investments in distressed communities.

"It is expected that requests will continue to skyrocket at an unsustainable pace in the coming weeks, putting insurmountable cash-flow constraints on many servicers," said Mike Fratantoni, senior vice president and chief economist at the MBA.

The constraints will be particularly hard on independent mortgage bankers that lack a source of cash from deposits. As of April 1, the percentage of loans in forbearance in IMBs' servicing portfolios was 3.45%. That request rate is 2.24% for banks and 2.73% for all loans.

The association's survey included data from more than 22 million loans in the first-mortgage market.

Providers of government-related loans must provide up to six to 12 months of forbearance without penalty if borrowers state they have coronavirus-related hardships, but consumers can still be considered liable for paying the full amount due in the future if they put payments on hold.