Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

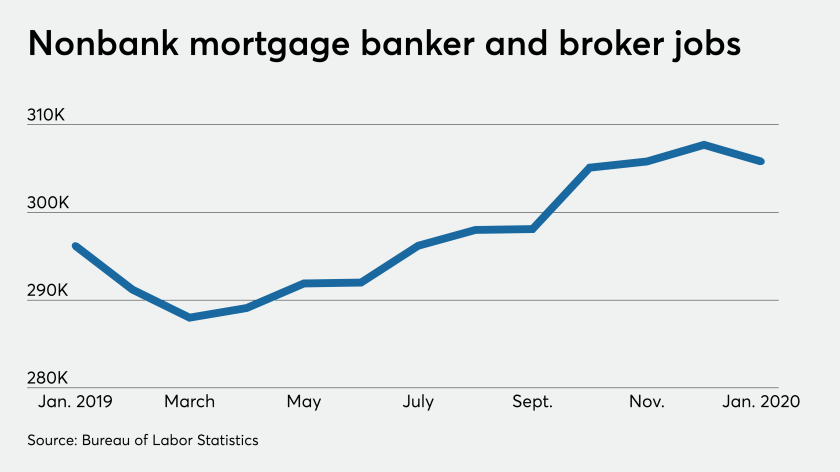

Estimated jobs generated by nondepository mortgage bankers and brokers fell to 305,800 in January from an upwardly revised 307,700 in December, according to the Bureau of Labor Statistics latest employment report.

That left housing finance companies unprepared for this week's unprecedented drop in mortgage rates.

"It's going to be a challenge to expand capacity and hire at a pace to keep up with volume," said Rob Clements, chairman of and CEO of industry vendor Covius Holdings.

But a mix of positive and negative economic indicators raise questions for lenders around how much to invest in new permanent staff positions.

On the plus side, overall employment strength recorded by the BLS on Friday is promising for mortgages when coupled with record-low rates.

Total jobs, which are reported with less of a lag than mortgage specific numbers, rose by 273,000 in February compared to 225,000 jobs added in January. In addition, the unemployment rate fell to 3.5% in February from 3.6% a month earlier.

"Strong job growth, coupled with a faster pace of home construction and record-low mortgage rates, sets us up for a very active spring market," Mike Fratantoni, senior vice president and chief economist at the Mortgage Bankers Association, said in an email. "The caveat is, of course, the uncertainty regarding the coronavirus."

Indications of negative economic impacts from the virus started to surface in the travel and tourism sector, according to the Federal Reserve's Beige Book report on Wednesday.

Concerns related to travel put at least three industry conferences on hold in the past week.

The MBA canceled and promised refunds for a spring technology conference in Los Angeles on Friday; Goldman Sachs postponed a housing and consumer finance conference in New York earlier this week, and an interagency community reinvestment conference set to take place in Denver next week also was put on hold.

In addition, capital markets and rates remain volatile as a result of uncertainties related to the virus.

The yield on the 10-year Treasury note, for example, initially fell to a record low below 0.7% on Friday morning before recovering. Long-term mortgage rates are likely experiencing somewhat similar fluctuations. (While the 10-year is considered an indicator of mortgage-rate direction, there is potential for the spread between the two to widen due to capacity issues.)

"We are only beginning to understand and to see what the impact of the coronavirus is — and will be," Lindsey Piegza, chief economist at brokerage and investment banking firm Stifel, said in an email. "As far as hiring it's too soon to see the impact, but we would expect continued downward pressure on manufacturing payrolls as a result of disruptions to the international supply chain."