Santander Consumer USA in Dallas warned Wednesday about the possible fallout if Congress is unable to reach a deal on further economic stimulus as new COVID-19 cases are mounting.

The $48.4 billion-asset company is especially exposed to the economic downturn stemming fom the pandemic because of its heavy subprime lending business. Of the 645,000 accounts that had payments deferred until September, 13% have already fallen more than 30 days past due, representing about $1.5 billion in auto and other loans.

For now, Santander Consumer has kept charge-offs contained, but management warned that they’re expected to mount around the end of the first quarter of next year — signaling the likelihood of a prolonged struggle ahead without further economic relief.

“While we feel good about what we've seen so far from the consumer, we also know that without additional government stimulus being approved many unemployed customers will have spent through their savings and the tide of this recession could easily turn,” CEO Mahesh Adity said on the company’s third-quarter earnings call.

Chief Financial Officer Fahmi Karam said that the company is no longer including a new stimulus package from Congress in its economic modelling.

The on-again-off-again negotiations between the Trump administration and House Democratic leaders over a rescue package will likely linger as the Republican-controlled Senate recessed until Nov. 9 after confirming a new Supreme Court justice this week.

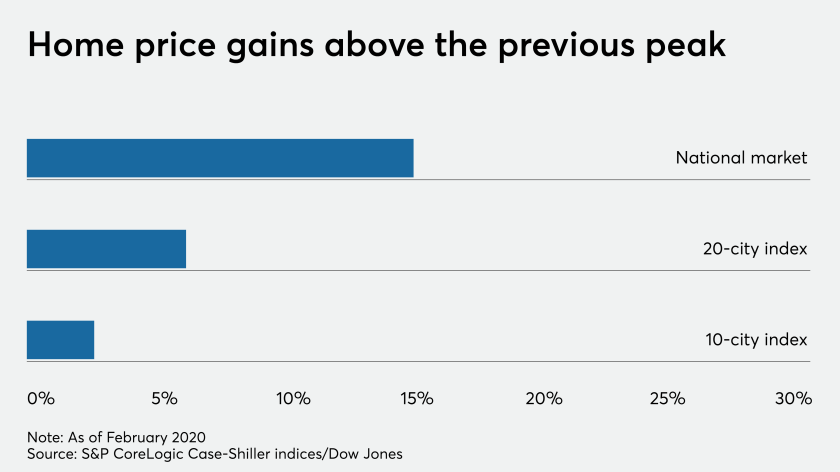

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

The auditing profession is responding to the novel coronavirus pandemic by adjusting how it conducts audits, and that’s evident in the Center for Audit Quality, whose CEO, Julie Bell Lindsay, took over the leadership job when the priorities for the profession and the CAQ looked far different.

In separate letters to Congress, the Fed asked for legislative action to ease Tier 1 capital minimums while the FDIC said it may use its own authority to address the market strain on banks.

“COVID-19 cases have continued to increase in most states, and another round of government stimulus may or may not be back,” Karam said.

The company estimates that the unemployment rate will hover just below 10% for the remainder of the year and remain in the “high single-digits” in 2021.

Santander Consumer’s third-quarter net income of $490.1 million was more than twice as large as the previous quarter’s profit thanks to a 7% increase in originations.

The company says it has been skewing toward writing higher-quality loans since the pandemic hit. About 44% of new loans Santander Consumer wrote in the third quarter had FICO scores above 680, compared with 36% of originations in the first quarter of this year.

Its total delinquency rate of 5% is about half a percentage point below the level seen last year as customers still lean on their savings built up from the original round of stimulus to make ends meet, executives said.

“As we get further into the pandemic, we do expect some of these accounts to roll through delinquency and ultimately charge off,” Karam said. “This is not unexpected as stimulus benefits have expired and unemployment remains elevated.”