As expected, Texas tax receipts for May were the worst in years, and in some categories in decades, Comptroller Glenn Hegar confirmed.

Sales taxes, which account for 57% of state revenue, fell 13.2% compared to the same month last year, the steepest decline since January 2010.

The majority of May sales tax revenue is based on sales made in April and remitted to the agency in May. Widespread social distancing requirements were in place across much of the state throughout April.

“Significant declines in sales tax receipts were evident in all major economic sectors, with the exception of telecommunications services,” Hegar said. “The steepest decline was in collections from oil and gas mining, as energy companies cut well drilling and completion spending following the crash in oil prices.

Critics of the Community Reinvestment Act revamp want to freeze the rulemaking process. That would only delay financial help to New York and other hard-hit cities.

While their regions, sizes and funding streams vary, several mass transit systems underscored the dire need for additional federal funding.

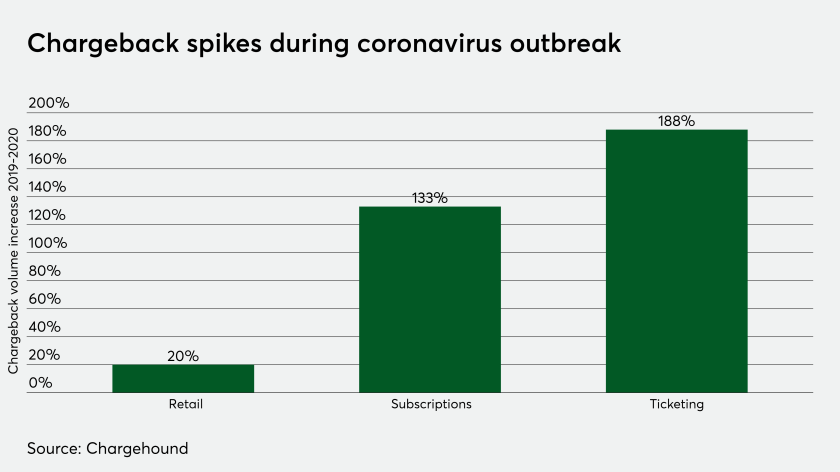

As credit card chargebacks accumulate during the coronavirus crisis from consumers seeking reimbursement for canceled trips and events, PayPal is extending an olive branch to merchants.

“The business closures and restrictions and stay-at-home orders due to the COVID-19 pandemic spurred deep drops in collections from restaurants, amusement and recreation services, and physical retail stores,” he added. “These declines were offset in part by increases from big box retailers and grocery stores that remained open as essential businesses, online retailers and restaurants that could readily pivot to takeout and delivery service.”

Hotel occupancy tax fell 86%, the biggest drop since 1982. HOT taxes support revenue bonds for convention centers and hotels across the state. The visitor and convention business has shut down completely.

Oil production tax revenue dropped 75%, reflecting the collapsing oil market as well as the COVID-19 pandemic that has sharply reduced fuel consumption worldwide.

Taxes on motor vehicle sales and rentals dropped 38% year-over-year, while motor fuel taxes fell 30%, the steepest drop since 1989, when Texas was reeling from one of the worst oil crises in state history.

“With the easing of state and local government social distancing orders beginning in May, business activity in the sectors most affected by measures to curb the pandemic should begin to slowly recover, but operations resuming at reduced capacity will result in continued reductions in employment, income and activity subject to sales tax for months to come,” Hegar said.

Texas economist Ray Perryman, principal of The Perryman Group in Waco, said the May figures are likely to mark the bottom for state revenues.

“The May tax report reflects sales in April, which was when the economic shutdown was at its peak level,” he said. “Because we saw some businesses able to reopen in May, I think the numbers will improve somewhat going forward, but it will take quite a while to fully recover. Because the rates are given relative to the previous year, they will likely remain negative for the next several months, but with the drops being less dramatic once we get past the months of extensive shutdowns — assuming the future disruptions can be avoided.”