The service is implementing a new temporary procedure for faxing the duplicate copy of Form 3115 for companies applying for an automatic change in accounting method.

The Internal Revenue Service moved to ease the tax burdens of private equity portfolio companies and heavily indebted industries.

The coronavirus outbreak has caused economic activity to crater, and Visa says its focus on services, partnerships and e-commerce has provided stability and a route to growth.

The service released the final regulations and other guidance on the deduction, which was amended by the CARES Act.

The coronavirus pandemic has opened up a number of specific areas with potential for the profession, according to leaders at the AICPA.

Democrats in Congress are criticizing how millions of economic impact payments authorized under the CARES Act are being handled.

Bill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

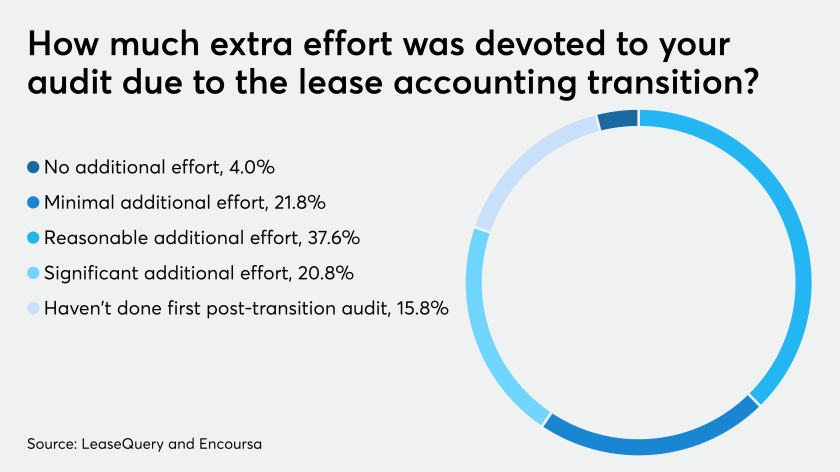

More than half the companies that completed their first audits under the new standard needed to make an extra effort.

New regulations to help employers reconcile any advance payments of refundable employment tax credits and recapture the benefit of these credits when necessary, in line with the CARES Act and the Families First Act.

Checkout-free stores still feel experimental, but the coronavirus pandemic is pushing more retailers to contemplate how to reduce human interaction in larger settings.