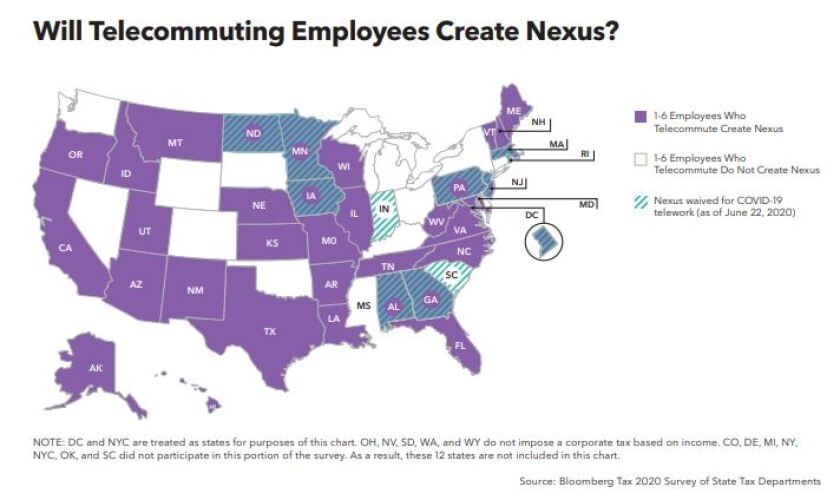

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.

The Internal Revenue Service said Wednesday it has begun to send letters to taxpayers who are seeing delays in the processing of their Form 7200, Advance Payment of Employer Credits Due to COVID-19.

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

Even the extra time to file hasn’t been enough for some businesses struggling to pay the government as the pandemic threatens to worsen.

The tax deadline is coming Wednesday after tax season was extended by three months to give taxpayers and preparers more time to deal with the novel coronavirus pandemic, but many of them will be dealing with extensions and amended returns in the months ahead.

The Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

The Senate and House passed bipartisan legislation to help nonprofits remain financially viable during the COVID-19 pandemic.

A subprime-related settlement between the government and Deutsche Bank provided meaningful benefits to some U.S. consumers in need, according to a new report. But the author acknowledged that those gains could prove illusory for some consumers given the coronavirus crisis.

The Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

The Internal Revenue Service and the Treasury Department provided guidance to employers requiring them to report the amount of qualified sick and family leave wages they have paid to their employees under the Families First Coronavirus Response Act on Form W-2.