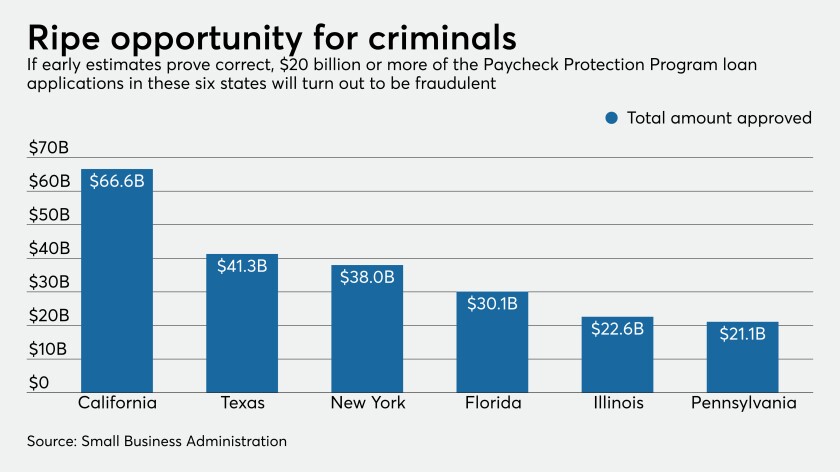

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

The tax prep chain is offering consulting services starting at $99.

The decision, prompted by requests from a bipartisan group of lawmakers, reverses previous IRS guidance.

The American Institute of CPAs’ Professional Ethics Executive Committee has decided to postpone the effective dates for three of its ethics interpretations in its Code of Professional Conduct for one year, due to the impact of the novel coronavirus pandemic.

The Internal Revenue Service said individuals who got a $1,200 stimulus payment intended for someone who’s deceased or incarcerated should return the money but left open the question of how the agency would enforce that.

When the coronavirus pandemic began, Square pushed hard to get a bigger share of merchants' online sales and consumers' stimulus spending — and even received its long-desired bank license — but found that this wasn't enough to offset the effects of the crisis.

Despite PayPal's efforts to get people to receive — and spend — their stimulus checks from PayPal accounts, the coronavirus pandemic caused its revenue for the first quarter to come in below company guidance.

The Internal Revenue Service has posted information on how people who weren’t supposed to receive their economic impact payments for the novel coronavirus pandemic should return the money.

A bipartisan group of lawmakers introduced legislation Wednesday to enable small businesses to deduct their expenses even if they have received a loan from the federal government’s Paycheck Protection Protection Program that was later forgiven.

The Settlement Days program is trying out remote options in Detroit and Atlanta.