Mayor Eric Garcetti announced plans to furlough thousands of city employees because of coronavirus-driven shortfalls.

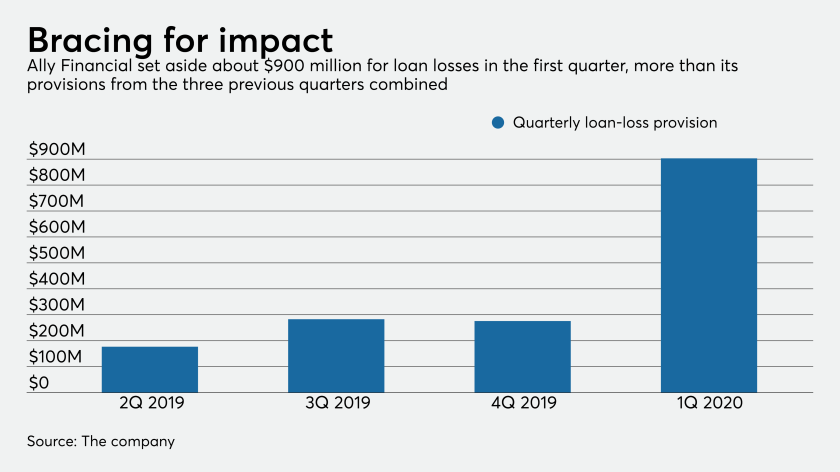

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

Fed officials also talk about the muni liquidity facility and efforts to help the economy in the wake of the COVID-19 pandemic.

Phil Murphy is developing an emergency borrowing plan to combat revenue loss amid the coronavirus pandemic.

Minorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

The Securities and Exchange Commission recently voted to exempt many smaller public companies from the Sarbanes-Oxley requirement for auditor attestations of their internal controls over financial reporting, but many companies have been able to bypass those audits anyway.

The Treasury Department and the Internal Revenue Service are partnering with the U.S. Department of Veterans Affairs to deliver economic impact payments automatically to veterans and their beneficiaries, without filling out extra forms, in response to the COVID-19 pandemic.

In addition to resources and information on various pandemic-related frauds, taxpayers can email the services tips directly.

Square Capital and other online lenders joined the Paycheck Protection Program just before it ran out of money. Now they’re ready and waiting for Congress to reload funds that could be better aimed at the smallest companies.