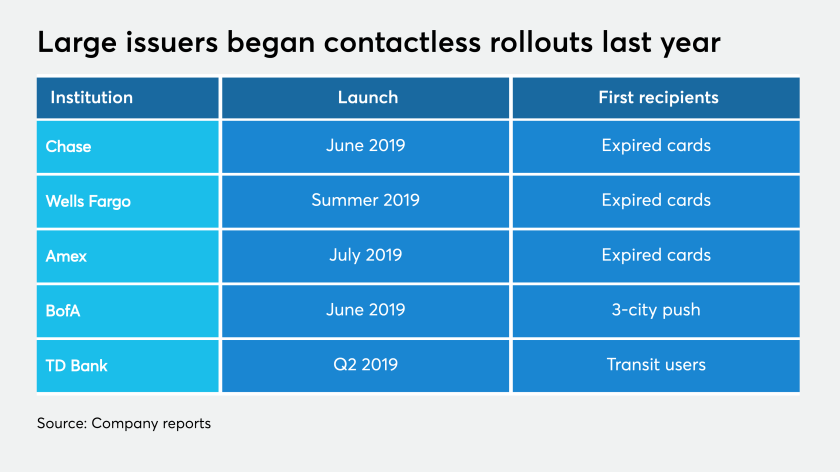

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

Illinois has spent about $170 million on coronavirus-related expenses so far, and Gov. J.B. Pritzker said more information on the budget impact is coming.

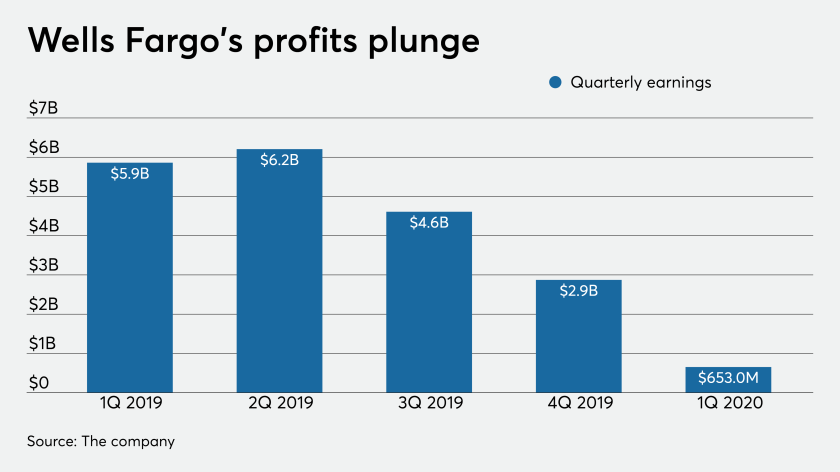

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

Small businesses are dealing with frustrating delays and changing guidance in applying for and receiving help from the Small Business Administration in its new Paycheck Protection Program.

A trade group says suspending so-called beneficial owner rules would help financial institutions make more small-business loans through the Paycheck Protection Program.

Nearly everything fell during the difficult first quarter: net income, advisory assets, IRA assets, and advisor headcount.

The Internal Revenue Service is encouraging taxpayers to file their taxes electronically during the three-month extension period for this year’s tax season.

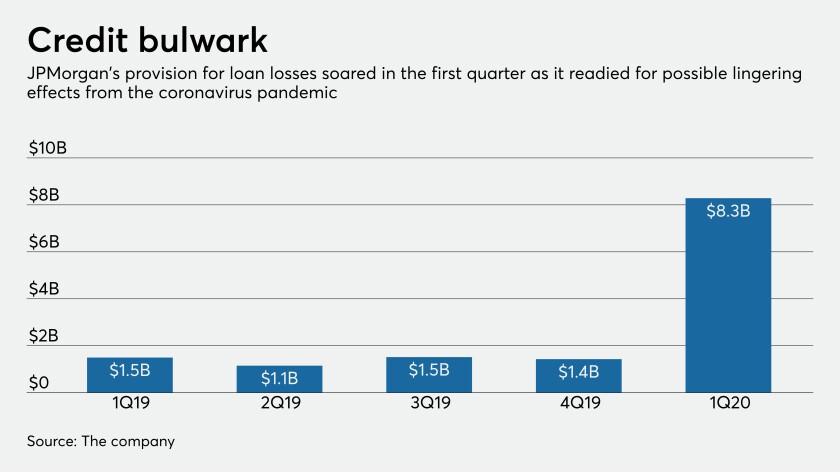

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

Due to the coronavirus, a plant in Indiana may not be able to make its bond payments.