Some people counting on $1,200 stimulus checks from the government may not see the money until mid-September, according to a House Ways and Means Committee analysis.

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

The firm’s CEO told staff there would be no headcount reduction in 2020 even as other industries have furloughed workers in droves.

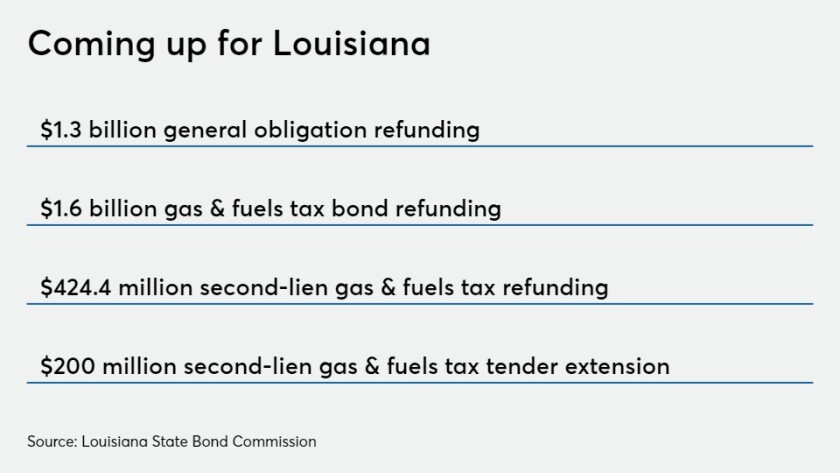

The Louisiana State Bond Commission authorized four bond issues, and was updated on market volatility created by the COVID-19 pandemic.

Early official estimates of current fiscal year revenue drops include $353 million in Arkansas, $396 million in Colorado, $219 in Oklahoma and $224 million in Vermont.

The Internal Revenue Service issued a warning urging taxpayers to beware of scammers calling and emailing them about the stimulus payments they are expecting as a result of last week’s CARES Act.

Ask the average business owner if they have a tax shelter and they’d probably have a chuckle while wistfully thinking about how nice it would be to swim in crystal clear waters while their offshore bank accounts grew, unencumbered by state and federal taxes.

Negative outlooks trigger questions about other reeling areas in the capital markets crosshairs.

The Financial Accounting Standards Board will be meeting next week to discuss the impact of the novel coronavirus pandemic on its stakeholders, including pushing back the effective dates of some of its upcoming accounting standards.