The bi-state transportation agency's executive director, Rick Cotton, recovered from virus than three weeks after testing positive.

The real estate industry, struggling with coronavirus-linked limitations, got a boost with its sales business reclassified as an "essential" industry.

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

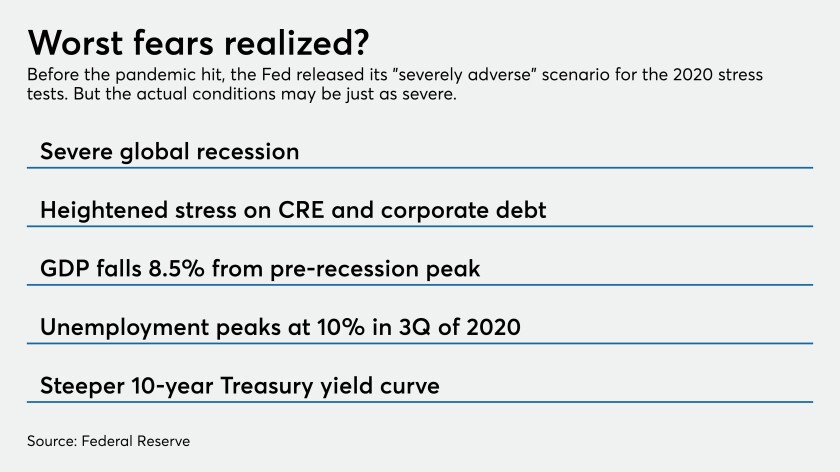

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

Online lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

Demonstrating compliance with pricing and supervision rules has been challenging in the COVID-19-influenced market.