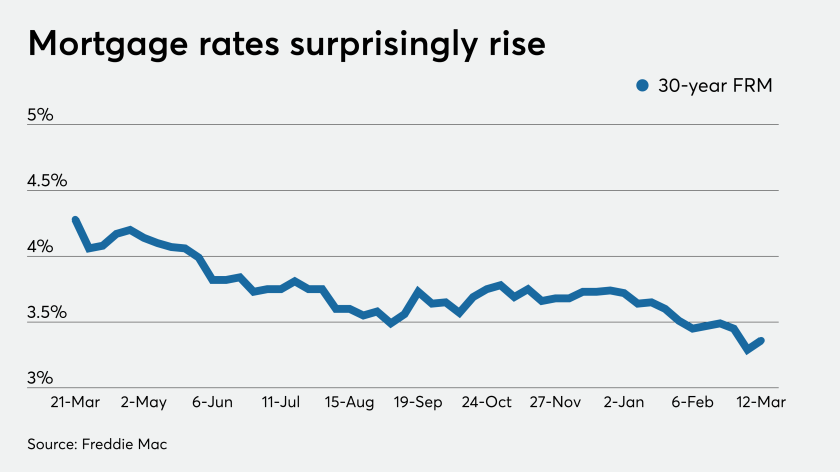

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

The coronavirus outbreak has thrust corporate policies on paid leave and workplace practices into sharp focus, especially for the retail and restaurant industries.

More than six industry events have been cancelled or put on hold in five days, with more likely to follow.

The central bank is trying to get ahead of possible funding disruptions caused by the coronavirus. Policymakers want to avert a repeat of September, when short-term borrowing costs spiked amid imbalances in supply and demand for cash.

The municipal market was hammered Wednesday by the COVID-19 pandemic with a more than quarter point correction in AAA benchmarks, issuers pulling deals off the shelves and more reports of pricing and evaluation confusion.

Where some see unacceptable risk, others are eyeing bargain airplane tickets.

Congressional offices may decide to minimize or ban face-to-face meetings as virus concerns grow.

The commonwealth plans a $268 million GO sale two days after Gov. Charlie Baker declared a state of emergency.

Investors fear the coronavirus may end the bear market. We check in with dealmakers from Riverside, Merrill Corp. and Paul Hastings about the potential impact on mid-market M&A. In deal news, Pepsi buys Rockstar to expand energy drink line.