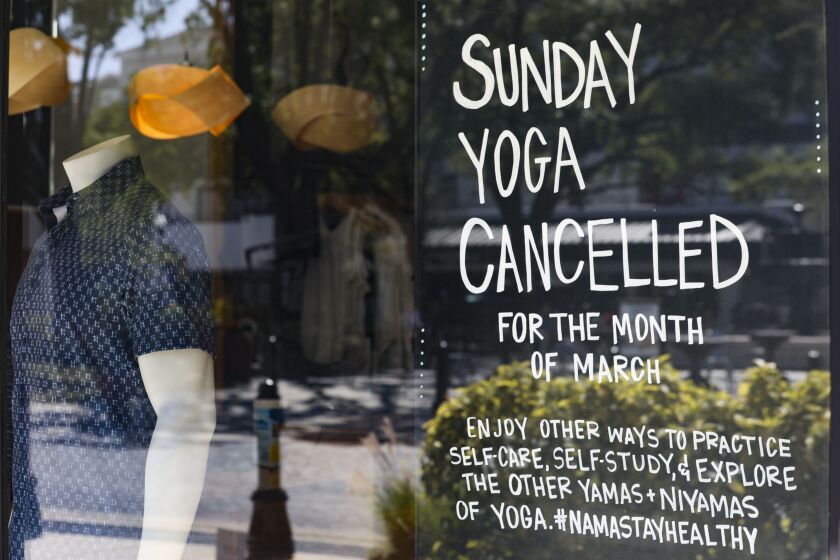

As the coronavirus pandemic began spreading around the globe with increasing speed in February and early March, cryptocurrency entrepreneur Erez Ben-Kiki and his wife, a professional yoga instructor, found themselves with a dilemma.

As they tried to move her business online — conducting classes via Zoom — they discovered that the process of monetizing such classes was surprisingly awkward. Ben-Kiki, the CEO and co-founder of 2Key Network, spotted a gap in the market.

At the end of April, 2Key launched SmartSessions, a plugin that any service provider can add to their Zoom call, forcing consumers to transfer funds in the cryptocurrency Ethereum before they can access their yoga class, pub quiz session or tutor group. So far it remains the only paywall approved by Zoom for free accounts.

PayPal can be used for webinars hosted on paid Zoom accounts, but that model wouldn't work for yoga instruction, said 2Key co-founder eiTan LaVi.

"Webinars are only available as a premium service for advanced and pricey Zoom subscriptions, and as a product they’re not suitable for the direct, mutual interactions you need for sessions provided by tutors, instructors, and therapists,” LaVi said.

Ben-Kiki's example is just one of many ways the uncertainty posed by the pandemic has translated into greater opportunity for cryptocurrency providers, particularly as traditional currencies have dropped in value. With businesses and consumers forced to turn to digital-only commerce amidst societal shutdowns, the global availability of cryptocurrency has proven attractive.

“What we've seen is that many service providers discover they have to modify their offerings so that they are more accustomed to the online medium,” said LaVi. “Their audiences are also changing to a much more geographically diversified market. Cryptocurrency offers a huge advantage in this respect as it makes monetizing a service to an international client base trivial.”

Taking care of people and partnering through new forms of communication are central to how accounting firms are taking stock of their practices right now

In the works for months, Mastercard Track Business Payment Service rolls out Tuesday with the goal of improving efficiency around corporate buyer and supplier payments at a time when these processes are uniquely constrained by the coronavirus pandemic.

MACPA offers a guide to keeping staff safe and healthy when the time comes for them to return to the office.

For other cryptocurrency providers, the picture has been more mixed. Blockchain payments processing provider BitPay has experienced a downturn in some key markets, while demand in others — most notably software, IT services and currency exchange — increased by as much as 40% in the first quarter of 2020.

Wirex saw the volume of cryptocurrency transactions on its mobile payments platform — which allows customers to exchange and spend traditional and digital currencies — rise by 100% in March compared to February. However it is also feeling pressure from competition in the space, which has grown in recent months.

“The market is becoming increasingly saturated, meaning we are endeavouring to remain on top of our competitors,” said Wirex CEO Pavel Matveev. “Because of the exceptional circumstances at the moment, we are also working particularly hard to reassure new and existing customers that their money is safe with us.”

Matveev and other cryptocurrency experts point out that in many respects, the past few months have served as a pilot study for the mass adoption of a digital economy, and highlighted the value which cryptocurrency can offer the business world.

Wirex is looking to build on this by expanding into new markets in the second half of 2020, providing various regulatory hurdles can be overcome. “We will be entering the U.S. market later this year, and with several hundred thousand people already on the waiting list, we expect a strong launch,” said Matveev.

“We are also working with regulatory bodies in actively seeking to obtain licences where they exist, and apply ‘gold-plated’ standards where they don’t, which can sometimes be a challenge in an arena that is continuously developing," Matveev added. "We are currently in the process of obtaining licenses in Singapore and Japan, and are working with the Monetary Authority of Singapore to apply for the Payments Services Act in Singapore, for which we have been given a temporary exemption. This will give us a licence to continue [offering] our services in the country, as the Singapore authorities begin to recognise the need for regulatory frameworks that protect consumers and businesses using the blockchain.”