As the coronavirus pandemic has forced branch closures and halted many mail-in applications, consumers have increasingly shifted to phone and digital channels to open new accounts and service existing ones — creating new challenges in fighting fraud.

Discover transitioned all of its 8,000 U.S.-based call center personnel to work from home within a matter of days following the U.S. declaration of a national emergency on March 13. By March 20, Discover had 95% of its agents working from home using a thin- client device to emulate their call center desktops.

While this has proved critical in keeping employees safe, it has also created a new learning challenge.

Traditionally, call centers employees work in teams because it aids in the fight against fraud and improves overall customer satisfaction, since a team leader is able to provide real-time, “in the moment” teachings. In a distributed environment, this practice is much more difficult and creates an opportunity for potential fraud to be overlooked.

“We’re learning a lot about how to collaborate in this environment. I think it’s forced us to become better connected in working from home than when we were all in our offices," said Dennis Michel, senior vice president of customer service and engagement at Discover. "It’s important because we’ve seen an uptick in travel-related chargeback disputes — 300% higher overall and airlines alone up over 967%. We need to address valid customer requests quickly."

Addressing valid customer disputes is important, but so is figuring out if there is an attempt at first-party customer fraud. For many companies, including Discover, the amount of telephone calls received has risen significantly since mid-March, exacerbating the transition process since there has been no easy way to change a company’s operations on such short notice.

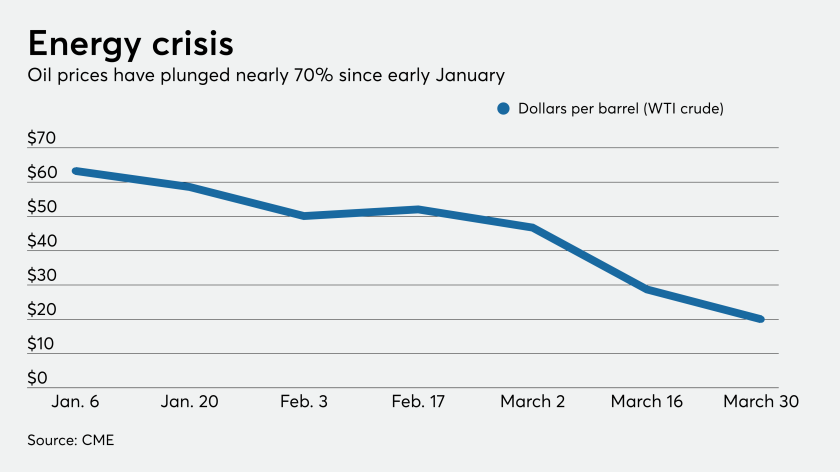

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

Municipal bond issuance was $67.88 billion after the first two months of 2020 and was on pace to easily eclipse the $400 billion mark — then COVID-19 completely turned the market upside down.

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

Working from home has also forced Discover to be creative in verifying how it confirms who is calling its agent to make sure callers are who they say they are, and where they are.

“We have built a filter that tracks the inbound call, somewhat similar to a caller ID to identify who is calling and where they are calling from to help us,” Michel said.

Now nearly 95% of Discover’s new account applications are online. In other words, mail-in applications for new credit cards are all but nonexistent.

Fraud and CARES

The coronavirus crisis has caused a flurry of financial activity as consumers and businesses scramble to access loans, open new accounts and take other steps to pay bills — and in the case of many small businesses, survive until life can return to normal.

“Fueling this growth in fraud is that in the CARES Act, there is a bias toward speed of payments for disbursements since the economy is on the line," said Scott Clements, president and CEO of OneSpan, which provides digital identity verification and authentication tools to thousands of banks and credit card issuers.

"This creates a perfect opportunity for fraudsters since there is a lot of data out there and fraudsters can create synthetic identities. That’s why we are seeing so much new account fraud growth," Clements said.

In a recent OneSpan survey of financial institutions, stolen identities and synthetic identities were the top two sources of fraud as a result of offering digital account opening by the companies that experienced fraud in the past year.

“One thing that we are seeing with the pandemic is that it’s not necessarily causing new things to happen. Rather it’s accelerating what was already occurring — financial institutions transitioning their account opening to online channels," Clements said. "Further, it’s also forcing banks to look at the entire account-opening process, not just one piece of it. This is important since banks are now experiencing a rise in new-account fraud, even higher than account-takeover fraud."