Despite PayPal's efforts to get people to receive — and spend — their stimulus checks from PayPal accounts, the coronavirus pandemic caused its revenue for the first quarter to fall short of company guidance.

PayPal also took major credit reserves against future losses, leading earnings to remain flat.

"We began to see some COVID-19 impacts in late February, but the strength of our overall business outweighed cross-border weakness coming out of China. However, all that changed as we exited the first week of March,” said Dan Schulman, president and CEO of PayPal, in the earnings press conference.

PayPal was significantly impacted during March by shelter-in-place lockdowns and consumers spending significantly less. The hardest hit spending categories were travel, hospitality and entertainment, with Schulman noting that three specific customers — Uber, Airbnb and events promoter Live Nation — saw rapid drops as consumers stopped traveling and events were canceled or postponed.

First quarter revenue fell short of the financial guidance of 17% to 18% that PayPal provided on Jan. 29. Total revenue in the first quarter was $4.62 billion, up only 13% on an FX-neutral basis compared to the same quarter one year earlier. PayPal non-GAAP earnings per share (EPS) were $0.66 for the first quarter, which was flat versus the same quarter a year earlier. EPS for the first quarter was impacted by PayPal taking a $0.17 per share credit loss reserve to protect itself from the weakened macroeconomic outlook. Had the unexpected credit loss reserve not been taken, PayPal EPS would have been $0.83, an increase of 26% compared to the same quarter one year earlier.

PayPal was one of many payment companies that lobbied the Treasury Department to be offered as an option to receive stimulus payments as an alternative to a mailed check. PayPal also provided instructions for how to receive stimulus funds to a PayPal Cash Card, which could already receive tax refund deposits.

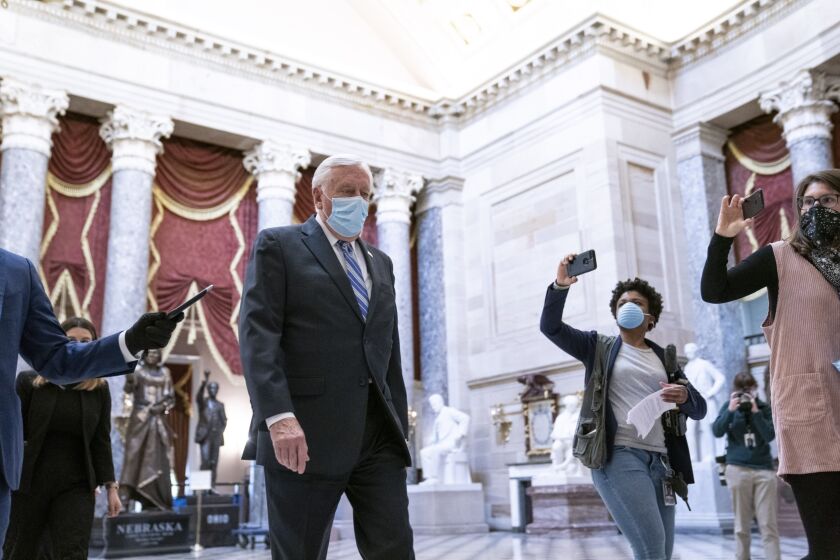

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

The proposal would give a safe harbor to financial institutions that work with cannabis companies in states where the substance is legal. But the bill, which would direct $3 trillion in aid to struggling households, businesses and local governments, faces long odds in the Republican-controlled Senate.

These efforts, combined with a global shift toward digital payments, led to a dramatic shift influx of net new accounts starting at the end of March. In the month of April PayPal added 7.4 million net new accounts and it expects to add a total of 15 to 20 million net new active accounts for all of Q2. TPV rebounded in April by about 22% and revenue was up in the month by 20%.

“I would characterize April as perhaps our strongest month since our IPO,” Schulman said.

The global pivot toward digital payments and in-store contactless payments has been so dramatic, Schulman said, that it was clear that digital payments have become essential for any merchant.

PayPal also highlighted the opportunity to bring contactless to in-store transactions. Executives noted that they have been receiving demands from merchants to enable PayPal at POS.

“In the past month there has been unprecedented demand for our products and services. On May 1 we had our largest single day of transactions in our history — larger than last year’s transactions on Black Friday or Cyber Monday," Schulman said. "Our net new actives hit record highs in April, surging over 140% from January to February.”

John Rainey, chief financial officer at PayPal, added that the company expects revenue to grow by 15% for the second quarter. However, PayPal said it was pulling its full-year financial guidance due to the unknowns surrounding the coronavirus crisis.