New York's mayor announced sharp cuts, a draw on reserves and a call for further assistance from Washington.

The agency is still moving forward on key regulations dealing with payday lending and mortgage underwriting despite new demands posed by the crisis.

The Internal Revenue Service announced new tool Get My Payment, enabling taxpayers to check on their Economic Impact Payment date and update direct deposit information.

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

A trade group says suspending so-called beneficial owner rules would help financial institutions make more small-business loans through the Paycheck Protection Program.

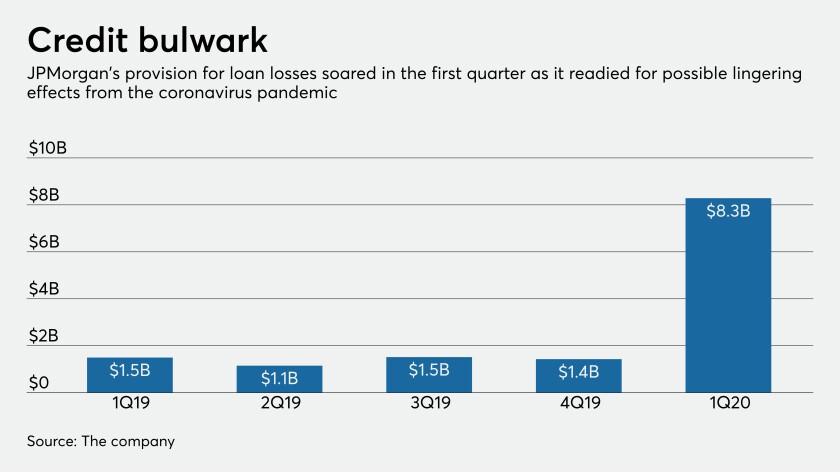

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

Republicans balked at measures like an overdraft fee ban and interest rate cap in the recent stimulus bill, but Sen. Sherrod Brown, D-Ohio, isn’t done trying to add such proposals to future relief packages.

Sherrod Brown, the top Democrat on the Senate Banking Committee, explains why consumer protection is so important as the coronavirus pandemic ravages the economy.

The Treasury Department has created a web-based portal through which state, local and tribal governments will be able to access payments to help offset the costs of the novel coronavirus pandemic.