No matter how bleak things may look right now, you can still help your employees plot a path back to being financially well. Here are four steps to help restore your employees’ financial confidence.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

For a few months this year, a U.S. government aid program meant for struggling small-business owners was handing out $10,000 to just about anyone who asked. All it took was a five-minute online application. You just had to say you owned a business with at least 10 employees, and the grant usually arrived within a few days.

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

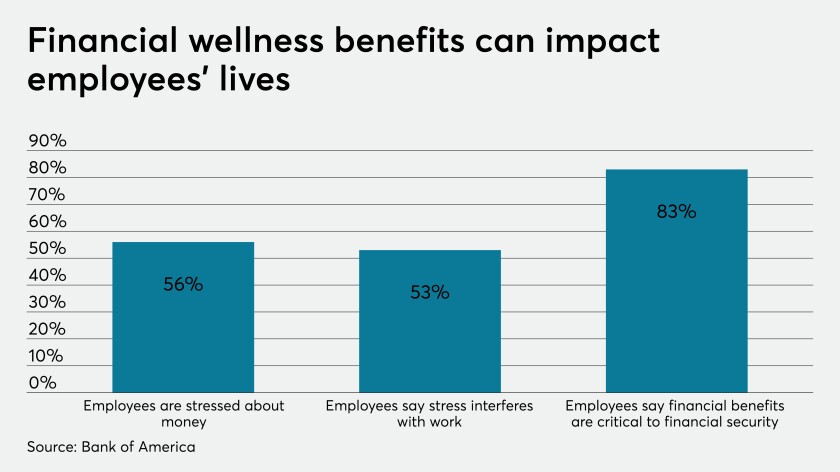

Many in the industry were adding counseling services to benefits packages even before the coronavirus outbreak spurred demand for assistance with mental well-being.

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

CBIZ’s new offering helps businesses at various stages of COVID-19 recovery.

The global bank, which has already closed more than 30% of its U.S. branches this year, indicated that the pandemic is prompting it to adjust its plans on the fly.

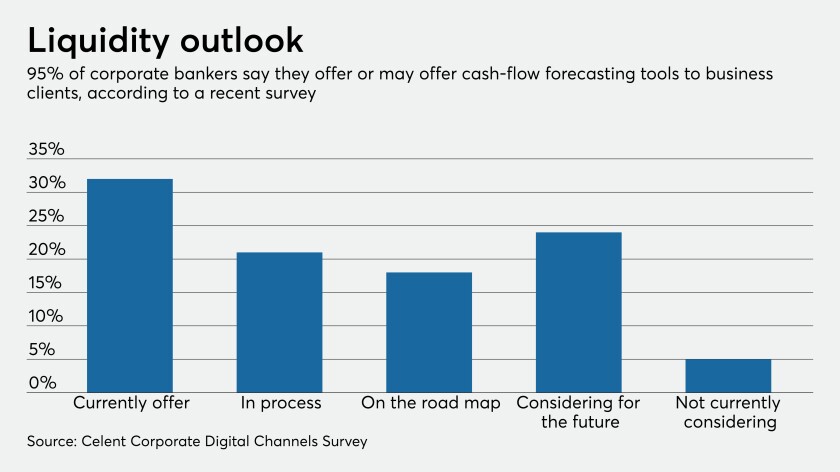

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.