White House officials said the administration has no plans to do away with the payroll tax despite President Donald Trump saying he would seek a permanent repeal if he wins another term.

The U.S. Small Business Administration has posted rules about how businesses who have been turned down for forgiveness of their Paycheck Protection Program loans can appeal the decision.

The American Institute of CPAs has sent a letter to top officials asking for more guidance on the president's executive order.

Firms of all sizes should be prepared to respond appropriately and help their clients protect the health and safety of their workforce by complying with ever-changing guidelines from federal, state and local authorities.

Payroll companies need guidelines on how to implement President Trump's executive order before they can start processing paychecks next month.

The White House isn’t considering an executive order to carry out President Donald Trump’s call for a cut in the capital gains tax because Congress probably would have to change the rate, administration officials said.

Among the pandemic-related issues covered are how to handle the Paycheck Protection Program and other stimulus efforts.

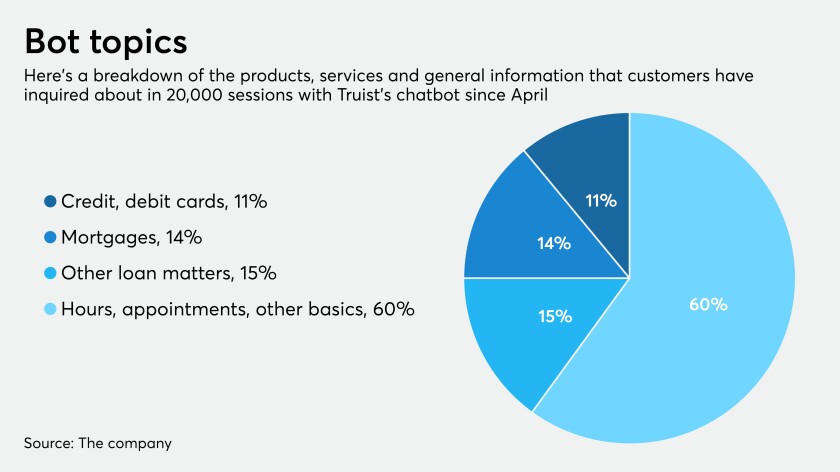

Built to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

President Donald Trump’s order to delay collection of payroll taxes thrusts a dilemma on U.S. companies: continue withholding the money from workers expecting bigger paychecks or pass it on and potentially put themselves or their employees at risk of a big end-of-year bill from the IRS.