The six largest credit card issuers have set aside billions of dollars worth of reserves in response to the novel coronavirus as well as the adoption of the Financial Accounting Standards Board’s new credit losses standard.

Several unemployed workers described the difficulties they are facing to senators as congressional leaders continue negotiations.

Tamera Loerzel and Jennifer Wilson of ConvergenceCoaching dive into the major issues that the COVID-19 pandemic has raised for accounting and tax firms — staff, technology, operations and more.

Talks to break an impasse over a new virus relief package become increasingly urgent this week with millions of jobless Americans left without additional aid, and the Senate scheduled to leave for an extended break on Friday.

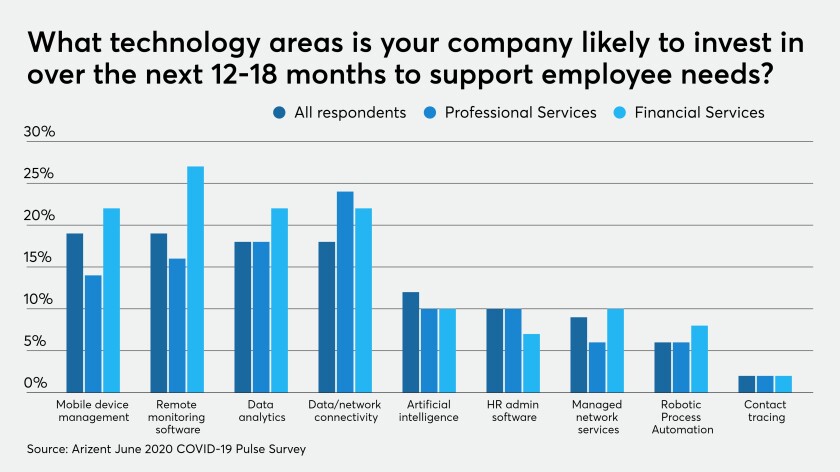

Some professionals have admitted to sleeping or drinking while working from home. Technology could help financial services firms ensure employee productivity doesn't slip.

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

This personal funding has blurred the line between personal and business finances more than ever.

Here are some companies should take as they respond and adapt to be more resilient.

Current economic conditions will have "a continued adverse effect on our businesses” if they persist or worsen, Bank of America warns.

MoneyGram International's digital transformation came at just the right time, considering walk-in traffic at MoneyGram locations in certain regions of the world was stymied for months by the coronavirus pandemic. But for many people, digital is still no replacement for the human touch.