Our second monthly survey found a smooth transition to remote work and digital customer access channels — but technology issues still arose. The pandemic has highlighted the importance of having a strong digital presence across all retail sectors, including financial services.

Artificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

Lax eligibility requirements are raising new questions about which firms should get access to public money.

The Small Business Administration’s troubled Paycheck Protection Program appears to be providing more businesses with long-awaited loans, despite the rocky rollout and ever-changing guidance, according to a new survey.

The Internal Revenue Service guidance caused some consternation among some small businesses and tax experts.

Divorce and COVID-19 each bring various tax considerations.

In this environment where information is fluid and everything is changing on a daily basis, accountants must stay out in front of clients’ needs.

The sharing economy faces its first true crisis, but the payment companies that enable nontraditional payrolls say that the best way to fuel the recovery is to simply be more creative in how people get paid.

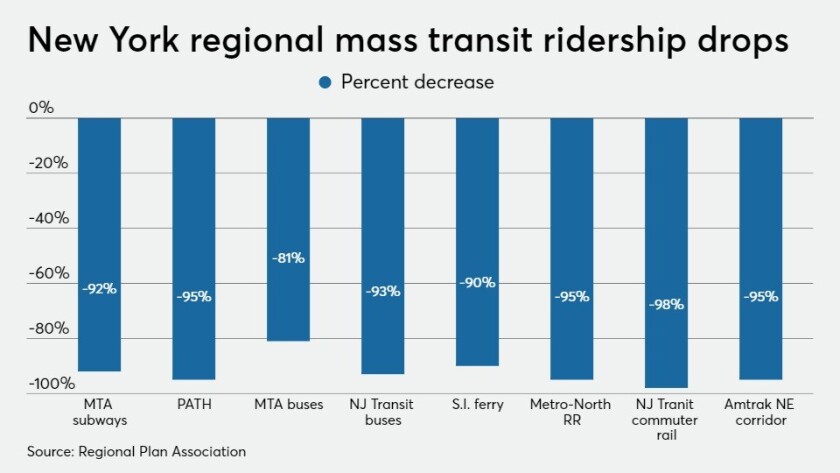

Congress should direct more COVID-19 relief dollars to higher ridership systems, think tank Regional Plan Association said.

A properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.