- 4 Min Read

Operation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

4 Min ReadCritics of the Community Reinvestment Act revamp want to freeze the rulemaking process. That would only delay financial help to New York and other hard-hit cities.

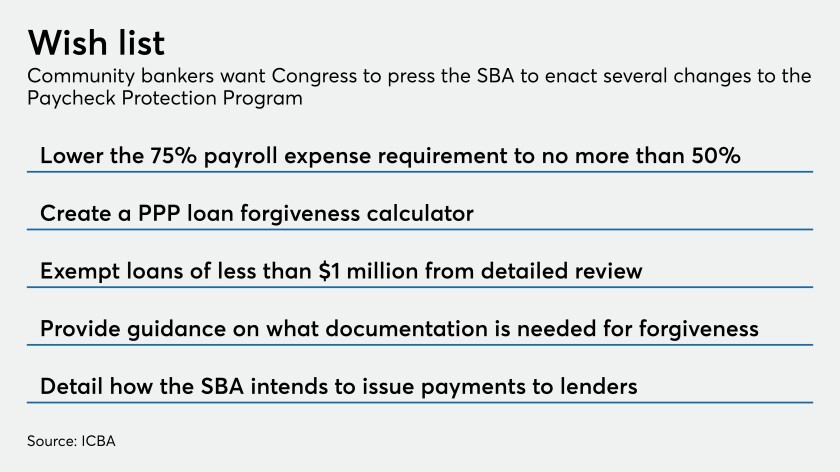

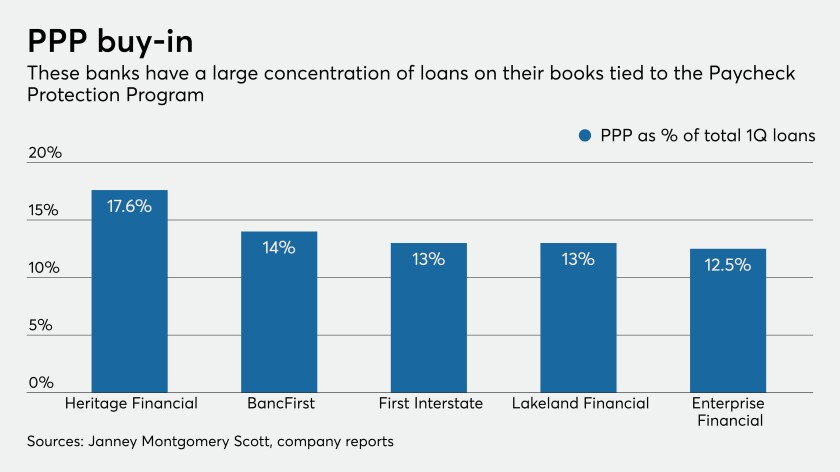

4 Min ReadBanks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

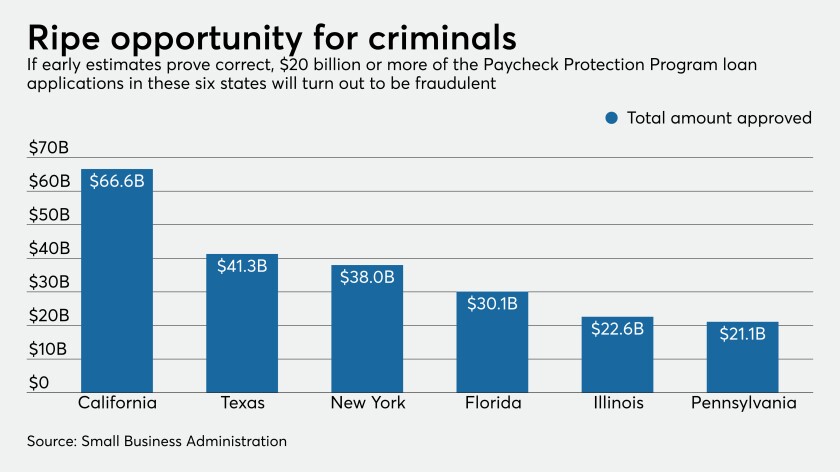

8 Min ReadUp to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

3 Min ReadCoronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.

6 Min ReadBankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

4 Min ReadRegulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

4 Min ReadIt's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

5 Min ReadThe program, created in response to the 2008 financial crisis, generated $19 billion in small-business loans. It could be used as a viable path out of the coronavirus pandemic.

2 Min ReadThe House is expected to vote later this week on the bill expanding emergency relief for small businesses reeling from the effects of the coronavirus.

3 Min ReadSmall banks are a lifeline for many local businesses and should be given first crack at distributing funds from a continuation of the federal stimulus program.

1 Min ReadLawmakers are considering a plan to reserve at least $50 billion in Paycheck Protection Program funds for customers of community banks and small regionals.

4 Min ReadMinorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

5 Min ReadThe Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

4 Min ReadThe SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

1 Min ReadA trade group says suspending so-called beneficial owner rules would help financial institutions make more small-business loans through the Paycheck Protection Program.

4 Min ReadUnlike in 2008, banks have become a steady force during the coronavirus pandemic.

4 Min ReadBy helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

3 Min ReadMany banks were hitting their limits for lending to small businesses devastated by the coronavirus outbreak. They say the Fed's decisions to help fund additional loans and relax capital requirements will resolve many of their problems.

3 Min ReadThe agency overhauled its system for the Paycheck Protection Program on Wednesday. Lenders hope it addresses the access issues and a crash that bedeviled the effort’s first week.