The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

KeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.

The pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

Lenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

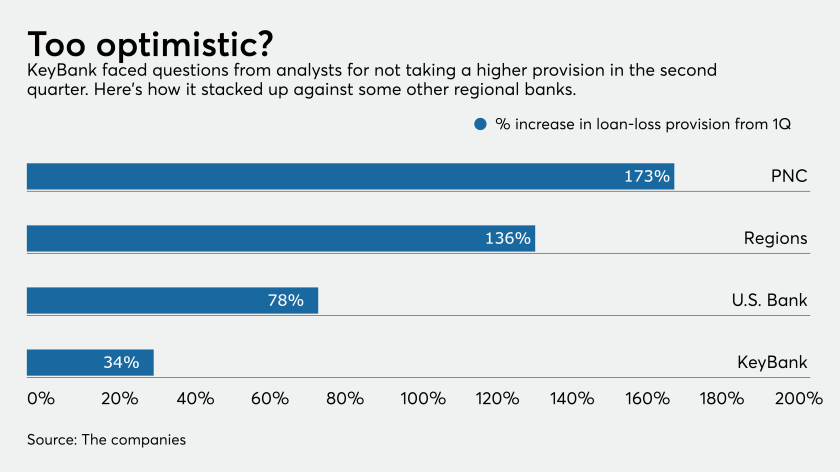

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

A subprime-related settlement between the government and Deutsche Bank provided meaningful benefits to some U.S. consumers in need, according to a new report. But the author acknowledged that those gains could prove illusory for some consumers given the coronavirus crisis.

Consumers now have more control over their own financial decisions and loan options.