- 3 Min Read

Artificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

4 Min ReadTokenization and buy buttons began, in part, as ways to calm the security concerns of online shoppers who were wary of moving away from plastic. They’re now becoming a way to keep a health and economic crisis from turning into a security problem as in-store checkout quickly gives way to apps and websites.

1 Min ReadGrant Thornton CEO Brad Preber and principal Linda Miller, who leads the firm’s fraud and financial crimes practice, explain why the coronavirus pandemic and the government response to it have created unique opportunities for fraud.

5 Min ReadEven before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

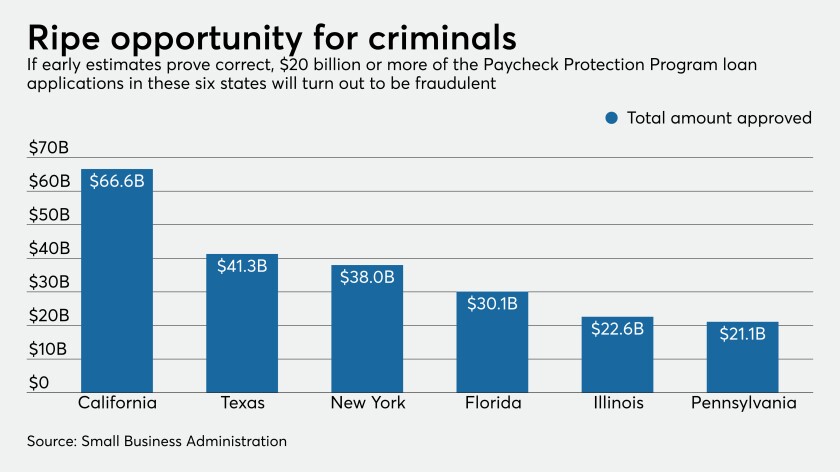

8 Min ReadUp to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

3 Min ReadDiscover transitioned all of its 8,000 U.S.-based call center personnel to work from home within a matter of days after the U.S. declared a national emergency on March 13. By March 20, Discover had 95% of its agents working from home using a thin-client device to emulate their call center desktops.

1 Min ReadIn addition to resources and information on various pandemic-related frauds, taxpayers can email the services tips directly.

3 Min ReadCredit card chargebacks were rising in certain categories prior to the coronavirus outbreak, but the pandemic is causing a spike in all types of payment card disputes.

5 Min ReadThe Internal Revenue Service is bracing for another epidemic -- scammers trying to get their hands on the $1,200 payments being sent out to millions of Americans to bolster the economy.

4 Min ReadThe coronavirus e-commerce push is likely to be permanent as consumers get used to digital payments, but that also gives rise to new fraud threats.

4 Min ReadThe potential for fraud fueled by the coronavirus pandemic, coupled with the anticipation of a $2 trillion stimulus, is creating such a lucrative opportunity for scammers that Visa and the Secret Service are predicting a wave of unprecedented levels of fraud.

3 Min ReadThe U.K.’s growing panic about the spread of coronavirus has created an open season for fraudsters, with government agencies and cybersecurity companies reporting unprecedented levels of criminal activity since the virus began sweeping across the globe in January.

4 Min ReadCard fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

5 Min ReadThe COVID-19 pandemic has already given rise to false marketing of test kits and criminals impersonating the FDIC. Consumer advocates say the bureau could issue alerts as well as empower banks to help safeguard their customers’ funds.

3 Min ReadWhile the global coronavirus outbreak may be grounding corporate travel to a near standstill, leading travel companies and fintechs are continuing to hone AI-based payments platforms to reduce the problem of corporate travel fraud.

4 Min ReadFinancial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.