The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

Most of the Top 100 CPA firms reportedly are showing significant increases in revenue in their SUT practices.

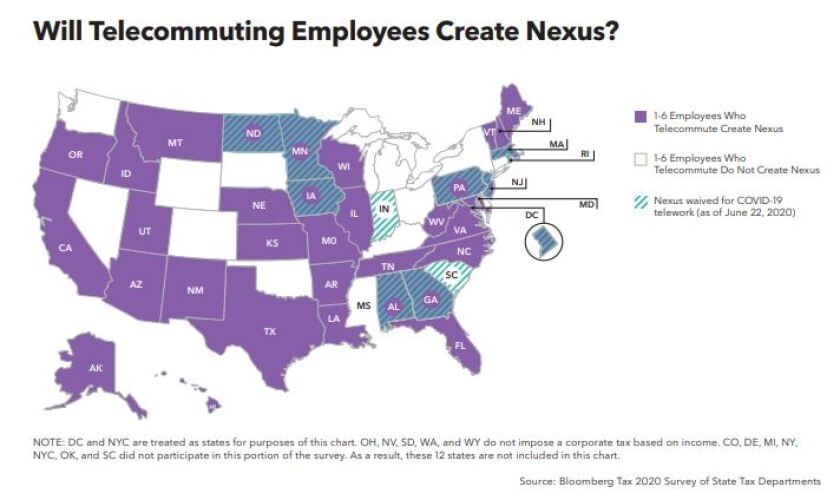

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.

The explosion in e-commerce since early March has resulted in a significant increase in online sales tax revenues in most states.

Lawmakers shouldn't let themselves be misled by a slower pace in personal bankruptcy filings so far this year.

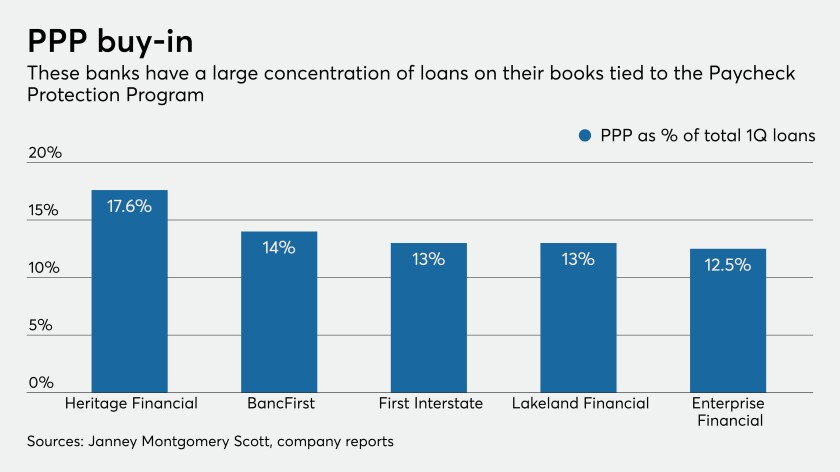

Accountants, as well as lawyers and consultants, who helped small businesses apply for emergency relief funds through the Paycheck Protection Program want to be compensated. Are they entitled to be?

The financial landscape is looking worse than lawmakers expected, sending states to ferret out every opportunity to expand, demand, and open new and broader tax pipelines. No business will be spared.

Divorce and COVID-19 each bring various tax considerations.

The Settlement Days program is trying out remote options in Detroit and Atlanta.

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.