- 4 Min Read

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

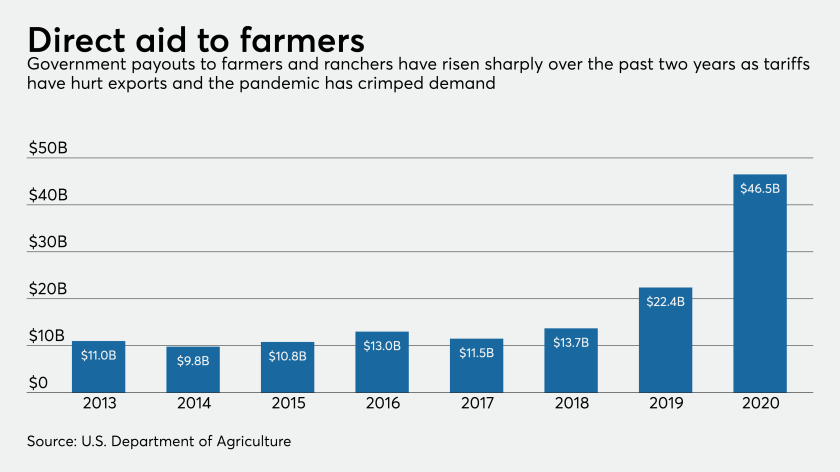

4 Min ReadThe Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

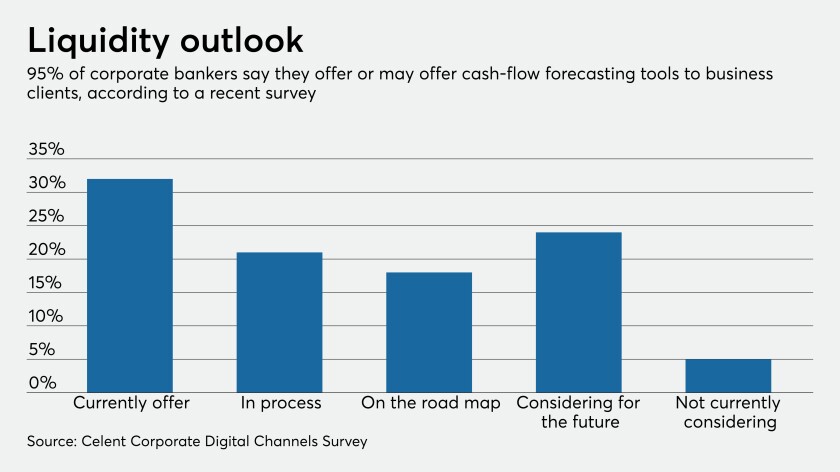

5 Min ReadThe global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

4 Min ReadForeign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

4 Min ReadLenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

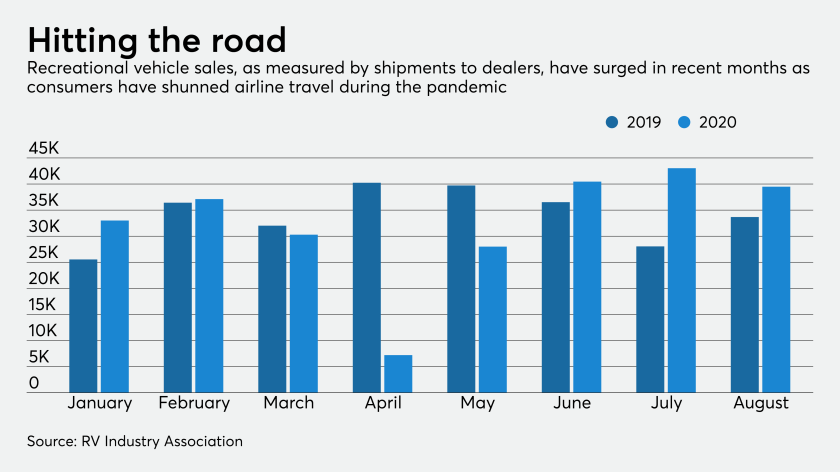

3 Min ReadMany consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

7 Min ReadSeveral companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

3 Min ReadWhen it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

3 Min ReadWhen it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

4 Min ReadThe move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

5 Min Read"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

6 Min ReadLenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

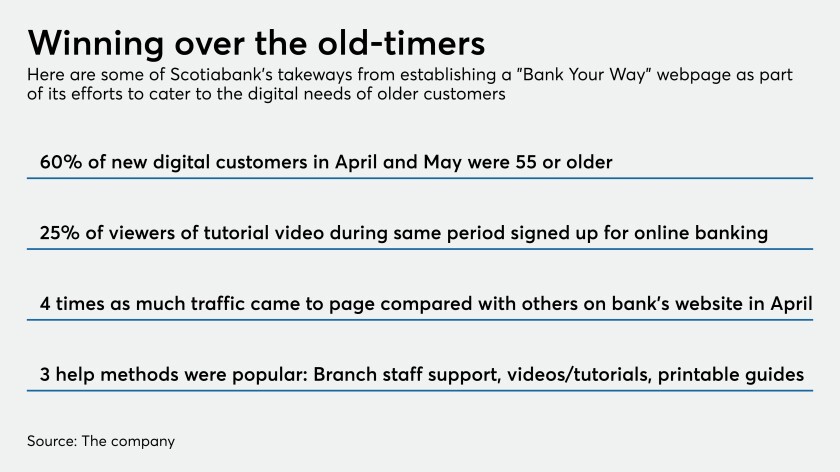

5 Min ReadThe Canadian bank is doing something few U.S. institutions have done: build an online hub with tutorials designed expressly to simplify the online banking process for newcomers.

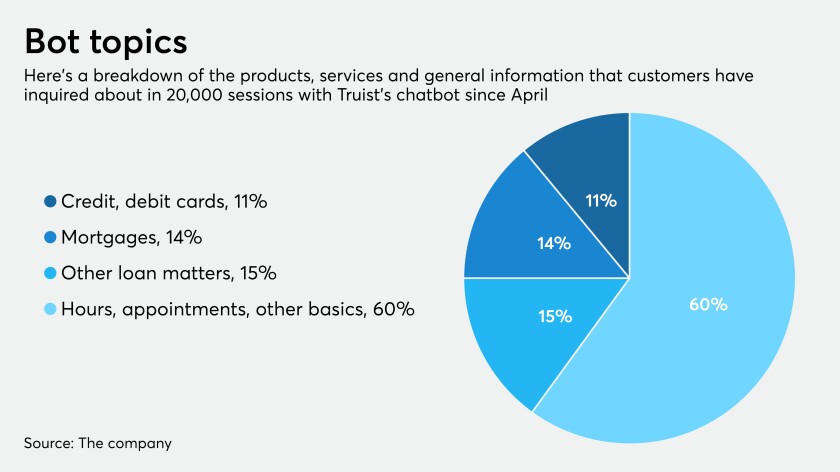

4 Min ReadBuilt to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

3 Min ReadA public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

3 Min ReadAs more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

6 Min ReadThe digital bank, founded by a former Western Union president, offers tools to help low- and moderate-income people access their wages early, pay bills and engage in other financial services activities for a monthly fee.

3 Min ReadThe coronavirus pandemic has forced some branches to close, but demand for in-person advice remains strong.

2 Min ReadThe prepaid card company benefited from payments that were designed to offset the pandemic’s impact on U.S. consumers.

7 Min ReadKeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.