- 6 Min Read

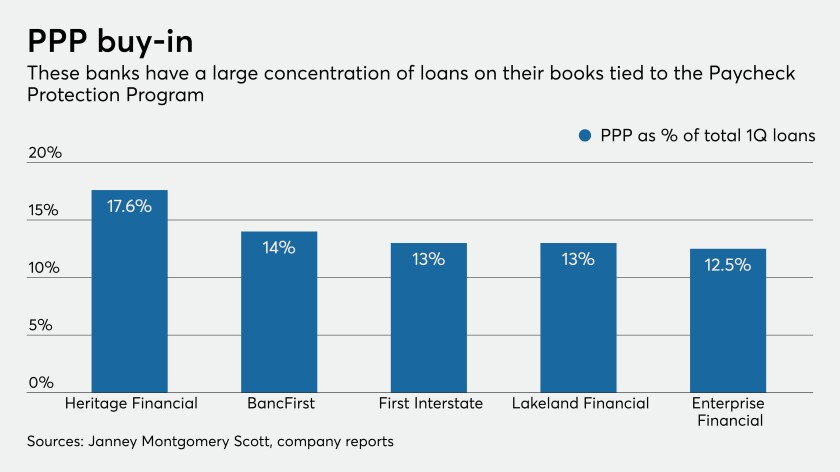

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

5 Min ReadBanks tend to pull back in times of crisis by tightening credit and focusing on collections efforts. But consumers, and not returns, must be the focus during the coronavirus pandemic.

6 Min ReadCredit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

4 Min ReadRegulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

4 Min ReadIt's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

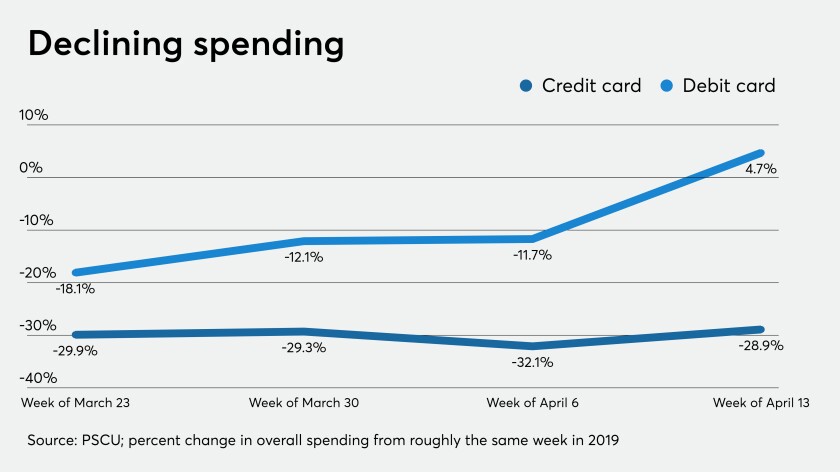

5 Min ReadConsumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

6 Min ReadFinancial institutions are finding that on-screen agents can offer most services that occur in a branch, but with a more personal touch than the phone or internet.

6 Min ReadUse of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

4 Min ReadLawmakers should approve a program to distribute stimulus funds using a government-sanctioned coin, which would be speedier than the current system.

5 Min ReadThe program, created in response to the 2008 financial crisis, generated $19 billion in small-business loans. It could be used as a viable path out of the coronavirus pandemic.

2 Min ReadThe House is expected to vote later this week on the bill expanding emergency relief for small businesses reeling from the effects of the coronavirus.

3 Min ReadThe pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

3 Min ReadSmall banks are a lifeline for many local businesses and should be given first crack at distributing funds from a continuation of the federal stimulus program.

1 Min ReadLawmakers are considering a plan to reserve at least $50 billion in Paycheck Protection Program funds for customers of community banks and small regionals.

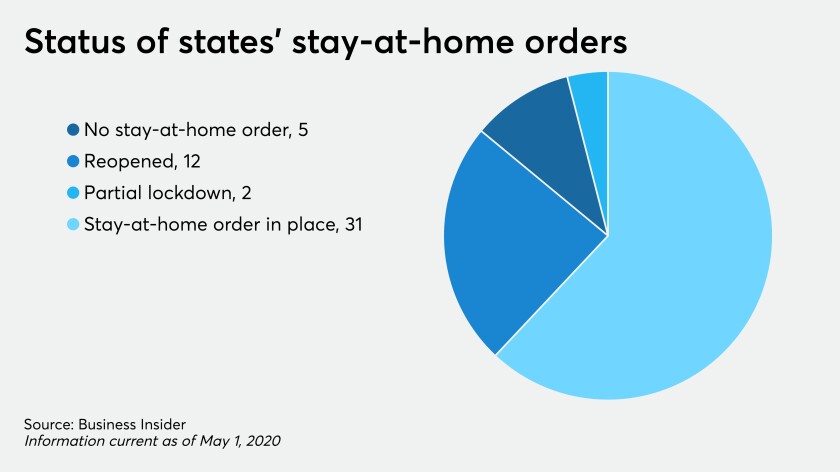

5 Min ReadFrom stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

4 Min ReadMinorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

5 Min ReadSquare Capital and other online lenders joined the Paycheck Protection Program just before it ran out of money. Now they’re ready and waiting for Congress to reload funds that could be better aimed at the smallest companies.

4 Min ReadConsumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

1 Min ReadThe plan first announced in February to update the deposit insurance sign and logo at bank teller stations and ATMs became just the latest regulatory effort slowed by the coronavirus pandemic.

5 Min ReadThe Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.