- 5 Min Read

Square Capital and other online lenders joined the Paycheck Protection Program just before it ran out of money. Now they’re ready and waiting for Congress to reload funds that could be better aimed at the smallest companies.

3 Min ReadIT projects are under scrutiny due to the coronavirus, not only in terms of budgets but also how fast firms can deploy automation for tasks such as business payments for companies that have turned to remote work.

4 Min ReadThe SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

6 Min ReadOnline lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

4 Min ReadUnlike in 2008, banks have become a steady force during the coronavirus pandemic.

5 Min ReadPayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

3 Min ReadCustomers in the challenger bank's pilot program drew down an average of $200 each in advance of the government's $1,200 payments.

3 Min ReadUpgrade's hybrid loan-card product can now be used without swiping as consumers and retail workers seek to minimize spread of novel coronavirus.

3 Min ReadThe agency overhauled its system for the Paycheck Protection Program on Wednesday. Lenders hope it addresses the access issues and a crash that bedeviled the effort’s first week.

4 Min ReadAdmitting it "may be professional suicide" to take the reins in the midst of a global health crisis, Brady Harris says his role atop Dwolla's management chain will be "a real test of my leadership abilities."

3 Min ReadLenders and government guarantors can use loan technology to bring immediate relief to business owners, former OCC official Jo Ann Barefoot says.

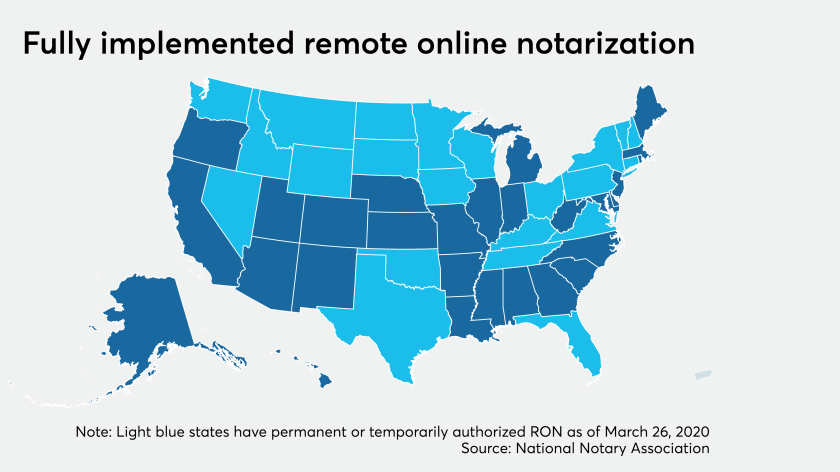

2 Min ReadAs the world practices social distancing to counteract spreading the virus further, it forces lenders to move as close as possible to an all-digital model, as quickly as possible.

4 Min ReadThe U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.

2 Min ReadOnline lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

3 Min ReadNo online lenders are approved for the agency's traditional programs, but they could make loans under the COVID-19 stimulus package if they get special approval.

3 Min ReadPayments technology is a relative bright spot as coronavirus’ economic fears hit venture capital, since an emergency can be a catalyst for early-stage innovation designed to ease digital commerce.

4 Min ReadMany borrowers will suffer unless the program, the central bank's latest response to the coronavirus pandemic, includes consumer loans issued by fintechs.

4 Min ReadOnline platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.

5 Min ReadPayments firm announces leadership changes; the bank will place restrictions on fossil fuel lending while adding to sustainable projects.

1 Min ReadAppraisals are viewed as a choke point in the mortgage process. As the ranks of appraisers dwindle and technology advances, a new, AI-driven approach may not be far off.