- 7 Min Read

U.K. fintechs are using their technology to assist British businesses and consumers during the coronavirus pandemic by helping banks disburse emergency business loans, enabling e-commerce merchants to offer installment payments to consumers, and giving employees access to salary advances.

4 Min ReadBankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

4 Min ReadThe $43 billion deal was one of a series of payment mergers in 2019 that were designed to combine bank technology and merchant acquiring across multiple markets and industries while warding off ascendant fintechs offering fast access to digital payments and working capital.

2 Min ReadNew digital tools have boosted advisors' ability to reach more — but not all — clients.

3 Min ReadArtificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

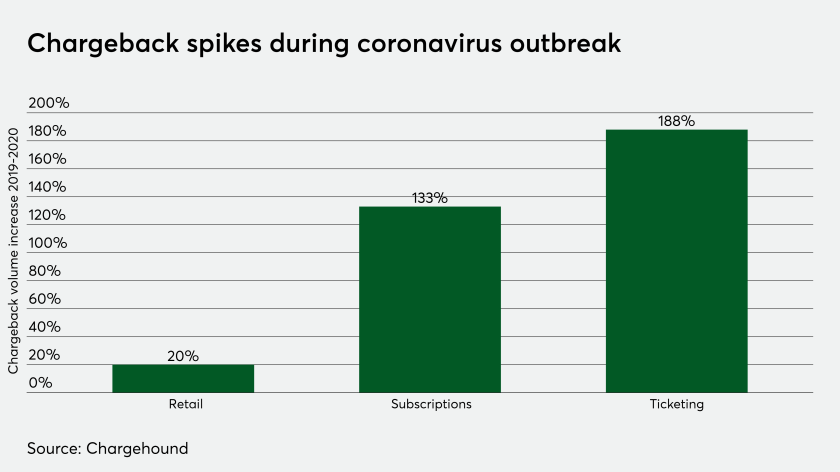

3 Min ReadAs credit card chargebacks accumulate during the coronavirus crisis from consumers seeking reimbursement for canceled trips and events, PayPal is extending an olive branch to merchants.

4 Min ReadCoronavirus has taken a massive toll on suppliers, and emerging invoice methods are getting thrust into the mainstream to rescue cash-strapped businesses.

3 Min ReadOne of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

3 Min ReadThrough its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

4 Min ReadWith the coronavirus pandemic forcing far more e-commerce transactions — and thus, more spending on cards instead of cash — loyalty and rewards are vital to creating lasting consumer habits.

3 Min ReadLocally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

4 Min ReadIt's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

3 Min ReadAmazon, Walmart and Facebook are using point of sale credit, deliveries and in-app payments to outflank Paytm in India, honing services that they see as vital to shaping the global economy's recovery.

2 Min ReadFintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

1 Min ReadFind more information and the nomination form for Financial Planning's recognition of people, leaders and firms that have demonstrated innovation in response to the coronavirus pandemic.

1 Min ReadThe online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

5 Min ReadJohn Pitts, policy lead for Plaid, has some ideas to ensure Paycheck Protection Program legislation set to be voted on this week targets the companies most in need of a cash infusion.

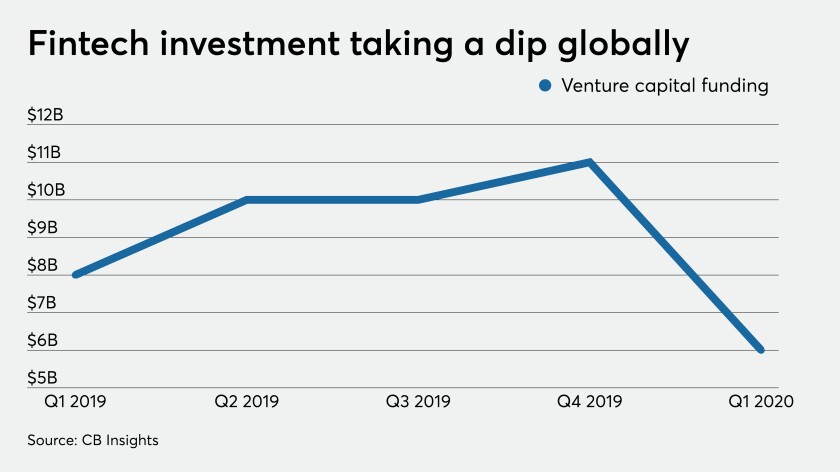

6 Min ReadVenture capital investment has plummeted in many coronavirus-ravaged economies, but larger, profitable fintech firms with the right digital products might still score funding.

5 Min ReadFrom stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

4 Min ReadFast-moving payments innovation was already threatening comfortable connections between consumers and businesses before the pandemic turned the trend into an outright crisis.