Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

As the pandemic has stretched on further into 2020, with more lockdowns and economic disruption predicted heading into the fall and winter, continuing to offer fee waivers has not always proved financially viable.

Just eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

The coronavirus outbreak initially looked like it might torpedo U.K.-based Paysafe’s plan to expand in the U.S. in 2020. But several months into the pandemic, the payments conglomerate sees ways it can grow by helping bruised small businesses retool operations.

Payment processor Elavon purchased Sage Pay four months ago, completing the acquisition on March 11. Two days later, Elavon's entire workforce was operating remotely as the coronavirus forced it into lockdown.

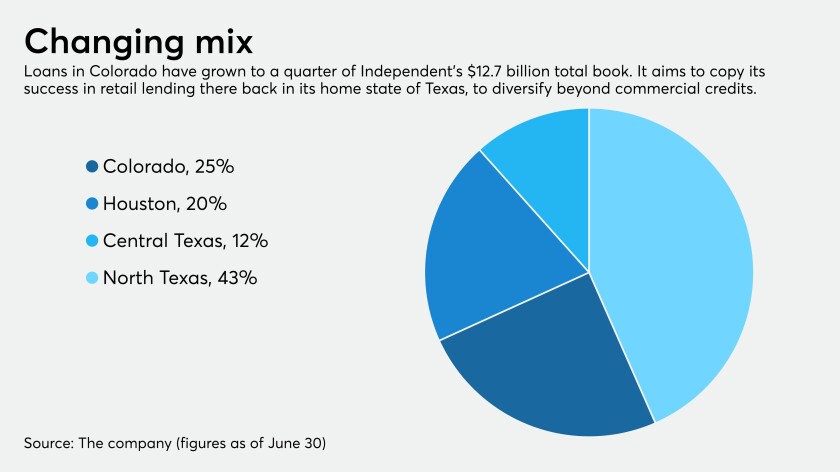

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

Republicans and Democrats are negotiating a new coronavirus stimulus package, but there’s still no law on the books designed to erase the problems that prevented many stimulus payments from getting directly to recipients.

Three months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

The deficits for the next two fiscal years remain unaddressed.

The spending and account management capabilities of corporate prepaid cards have been given new purpose in a pandemic-struck world dependent on government and charity aid.