WASHINGTON — Banks tightened lending standards across all loan types in the first quarter as the coronavirus pandemic upended the trajectory of the economy, according to the Federal Reserve’s latest senior loan officer opinion survey on bank lending practices.

Most banks reported that they began implementing stricter lending standards for borrowers in late March “as the economic outlook shifted” in light of news about the spread of the COVID-19, the Fed said in its April summary of the survey, which is conducted quarterly.

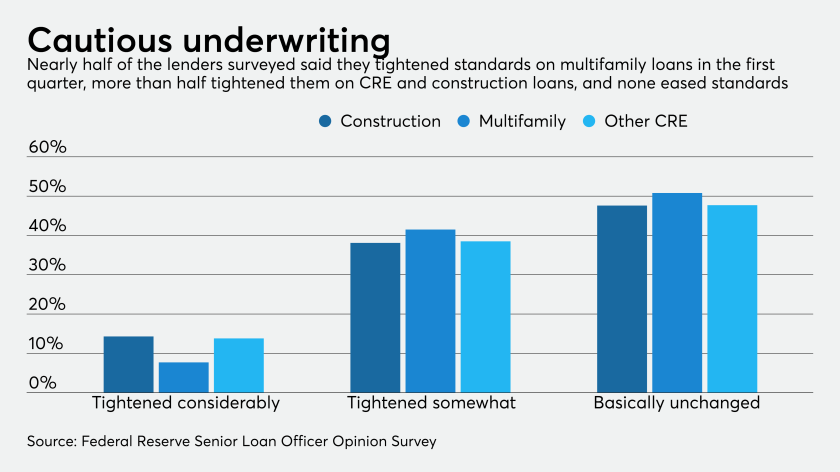

In particular, more banks said they had either significantly or somewhat tightened commercial real estate lending standards compared to other types of loans.

For construction and land development CRE loans, 52.4% of banks reported either significantly or somewhat tightening standards while 47.6% said their standards had remained unchanged over the past three months.

Additionally, for loans secured by multifamily properties, 49.2% of banks reported either significantly or somewhat tightening standards, while 50.8% said their standards had stayed the same.

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

The proposal would give a safe harbor to financial institutions that work with cannabis companies in states where the substance is legal. But the bill, which would direct $3 trillion in aid to struggling households, businesses and local governments, faces long odds in the Republican-controlled Senate.

Banks said they had experienced reduced demand for CRE loans across all major categories during the first quarter of 2020. They also reported weaker demand for consumer loans as well as commercial and industrial loans for small firms.

Meanwhile, demand for closed-end mortgage loans and commercial and industrial loans for large and middle-market firms increased during the first quarter, the Fed said.

For commercial and industrial loans, banks that experienced stronger demand said that more customers were requesting cash and liquidity as a precautionary measure and had reported a decrease in internally generated funds. Banks that experienced a reduced demand for those loans said that fewer customers needed merger or acquisition financing or investments in equipment.

Fewer banks reported that they had tightened lending standards for mortgage loans, though the largest share of banks said they had implemented stricter standards for “qualified mortgage” jumbo residential mortgages compared to all other mortgage loan products.

Just 1.9% of banks said they had tightened lending standards for government residential mortgage loans — loans insured by the Federal Housing Administration or guaranteed by the Department of Veterans Affairs or the Department of Agriculture — while 5.4% said they had introduced stricter standards for mortgages eligible to be sold to the government-sponsored enterprises.