- 2 Min Read

Economic experts believe the current surge is not enough to stop continued losses incurred by various segments of economy.

7 Min ReadWith consumers and merchants alike sharing the need to be paid faster, the case for adopting real-time payments globally has quickly advanced during the COVID-19 pandemic.

7 Min ReadThe Federal Reserve could ease capital rules, foster the creation of special-purpose banks and take other steps to strengthen minority communities and businesses without legislation being sought in Congress — if it has the will to do so, experts say.

2 Min ReadJust eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

7 Min ReadThe Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

4 Min ReadSome criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

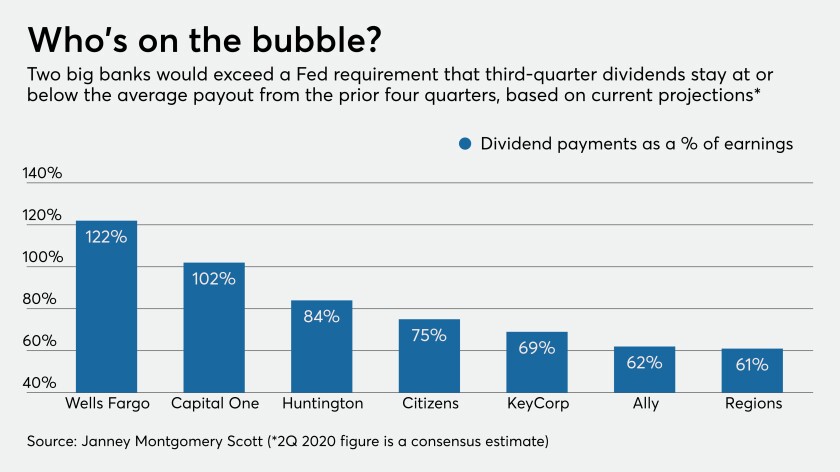

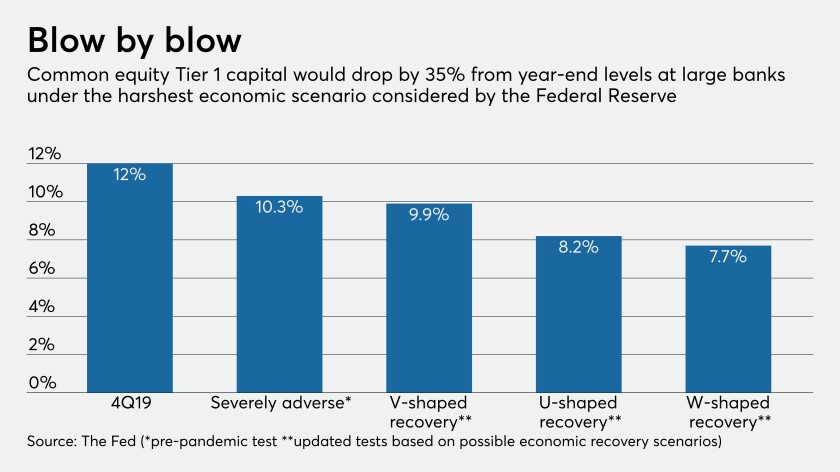

5 Min ReadThe Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

5 Min ReadThe Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

2 Min ReadThe American Institute of CPAs has organized a coalition of 21 business trade groups to push for help for businesses' short-term liquidity needs.

3 Min ReadFederal Reserve Chairman Jerome Powell said about 300 lenders have signed on to the program and that the central bank is committed to making adjustments that could attract more borrowers.

7 Min ReadSome observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

7 Min ReadIn the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

8 Min ReadParticipation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

6 Min ReadWorried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

5 Min ReadThe lender portal for the Federal Reserve’s Main Street Lending Program has opened as the long-awaited alternative to the problem-plagued Paycheck Protection Program after weeks of delays.

3 Min ReadChairman Patrick Foye said the designation will better position the authority to cope with the revenue loss from the coronavirus pandemic.

3 Min ReadMembers of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

2 Min ReadEven after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

5 Min ReadThe takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

1 Min ReadThe Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.