The COVID-19 pandemic delivered a sharp negative blow to second-quarter earnings at most U.S. banks — but not at Green Dot, which has benefited from emergency government payments to consumers that have been loaded onto the company’s prepaid cards.

Green Dot reported that its total operating revenue rose to $316 million in the second quarter, up 12% from the same period a year earlier. Though profits were hurt by rising expenses, and were down substantially from the second quarter of 2019, the Pasadena, Calif., company still managed to report modest net income of $3.3 million.

CEO Daniel Henry, who started at Green Dot in the spring, right around the time that stay-at-home orders took effect, declared success in his first full quarter at the helm. “I am very pleased with all the early signs of progress that we are making,” Henry said Tuesday during a call with analysts.

Shares in Green Dot have soared in 2020, in defiance of the industrywide trend. Its stock price closed above $53 on Tuesday, up from less than $24 at the start of the year. An index of bank stocks from Keefe Bruyette & Woods is down by 35% over the same period.

But relatively few audit execs are actually performing reviews of critical risk areas such as health and safety.

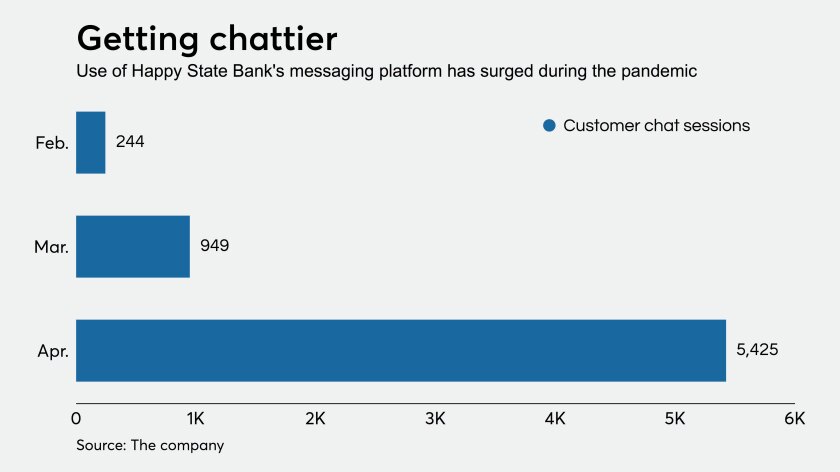

The Texas bank is leaning on solutions from Lightico and MANTL to quickly set up accounts and handle loans when customers can’t sign documents in person because of the coronavirus emergency.

As companies are evaluating continued operations, balancing profits with acceptable levels of loss, functioning with massively more remote work and trying to make up for economic disruptions, the first thought tends to be “How can we cut costs?”

In addition to the government stimulus payments, Green Dot is likely benefiting from the boost that digital payments have gotten from the pandemic. Many analysts expect that recent changes in how U.S. consumers choose to pay will be at least somewhat enduring.

The company’s share price may also be benefiting from Henry’s promise to keep expenses in tighter check. One early example of the new CEO’s mindset: Green Dot’s Unlimited debit card now offers less cash back on online purchases, plus a lower yield on savings, than it did previously.

Still, Green Dot saw its total operating expenses climb by 33% to $311 million during the second quarter. Henry said that call centers upon which the company relies experienced staffing disruptions amid the pandemic, which led to longer-than-normal wait times and higher costs for the company. The company also reported an increase in losses due to disputed transactions.

The Consumer Financial Protection Bureau has reported that consumer complaints about prepaid cards rose by 105% during the early stages of the pandemic.

Green Dot’s earnings in the latter half of 2020 will be influenced by whether Congress authorizes more stimulus payments and renews expanded unemployment benefits in the coming weeks. During the second quarter, the federal government’s extraordinary spending helped fuel $8.5 billion in purchase volume on Green Dot products, up 31% from the same period a year earlier.

But even if Uncle Sam stops writing checks, Henry predicts that Green Dot will benefit from a recently announced policy change that was spurred by the pandemic. Green Dot will allow all of its employees to work from anywhere throughout 2020, a move company officials argue will enable them to reduce real estate costs while also attracting better job applicants.