Financial satisfaction of people in the U.S. bounced back strongly in the third quarter, reversing the lows brought on by the coronavirus.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

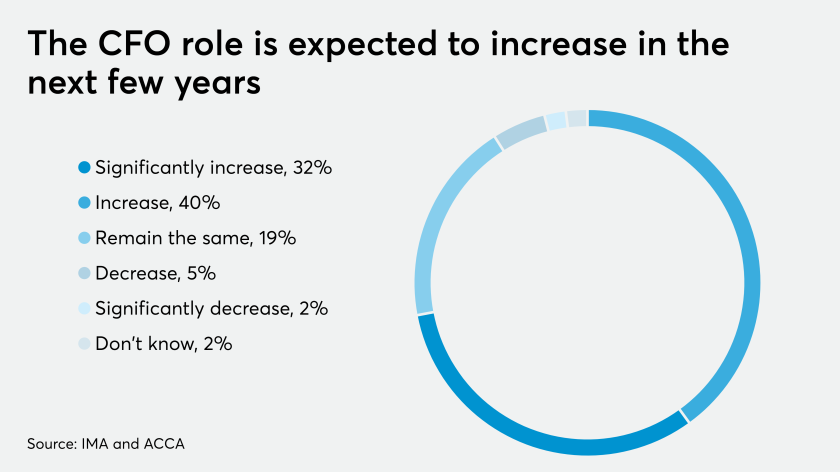

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

Accountants and tax professionals have been helping their small business clients deal with the economic fallout from the COVID-19 pandemic, shifting away from their routine compliance work after the end of the prolonged tax season.

The Internal Revenue Service is giving taxpayers until the end of the year before it stops its temporary procedures for faxing in Forms 1045 and 1139 for claiming tentative tax refunds.

Accounting firms Crowe LLP and BKD LLP released year-end tax-planning guides Wednesday, during a time of great uncertainty over future tax changes in the midst of the novel coronavirus pandemic and the upcoming election.

The coronavirus pandemic has introduced a number of new areas that companies need to address.

The U.S. Small Business Administration and the Treasury Department are making it easier for companies to get their Paycheck Protection Program loans of $50,000 or less forgiven.

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.