Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

The Office of the Comptroller of the Currency will use year-end 2019 asset totals in its calculating its next assessment, saying national banks "should not be penalized" for adding emergency loans to their books during the pandemic.

In a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

The Trump administration, following a backlash, said it would release details about companies that received loans of $150,000 or more from a coronavirus relief program for small businesses.

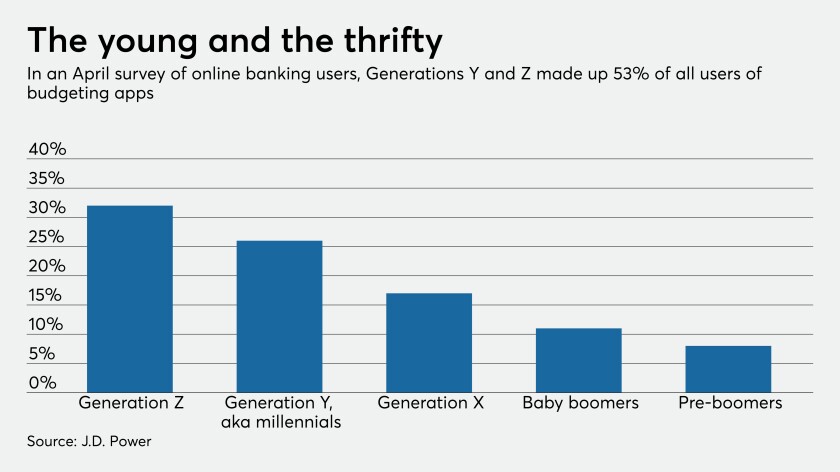

With money flow suddenly stifled for millions of customers, demand for money management tools has skyrocketed.

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

The Internal Revenue Service provided guidance on expanded eligibility and more.

Top division officials at the agency share updates on their compliance and service priorities.

Big Four firm Ernst & Young and its business tax clients at companies across the U.S. and other countries have faced a series of challenges amid the pandemic.

The bank says fraud attempts involving commercial wire transfers have escalated since the outbreak began. It's training employees and customers how to head off the often hard-to-detect scams.