The Internal Revenue Service is warning taxpayers and tax professionals once again to beware of tax fraud and other related financial scams related to the COVID-19 pandemic.

The Internal Revenue Service is giving investors in opportunity zone funds relief from some of the requirements in the controversial program because of the COVID-19 pandemic.

A backlash is growing among regulators and participants against EBITDA — earnings before interest, taxes, depreciation, amortization and coronavirus.

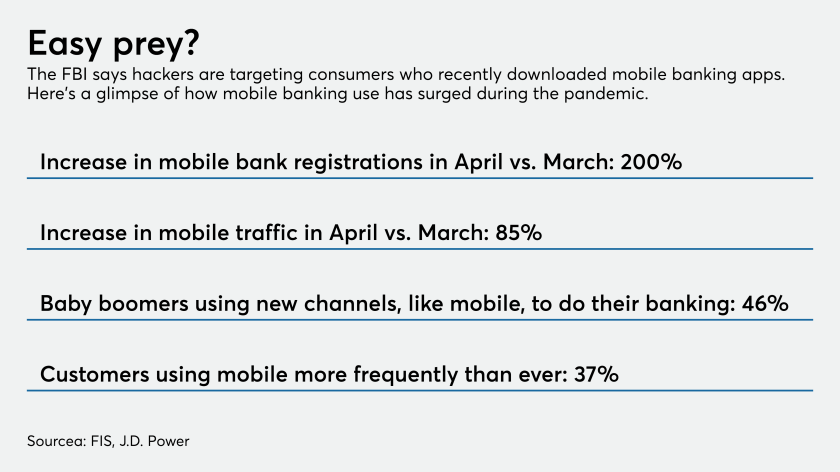

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

The Governmental Accounting Standards Board released a proposed technical bulletin Thursday from its staff with application guidance on the CARES Act and outflows incurred by state and local governments in response to the COVID-19 pandemic.

After three months of supervising national banks remotely, examiners will soon resume visiting them in person and working in regional offices, says acting Comptroller of the Currency Brian Brooks.

In the midst of a global pandemic, the gravitational pull toward digital transactions has been amplified.

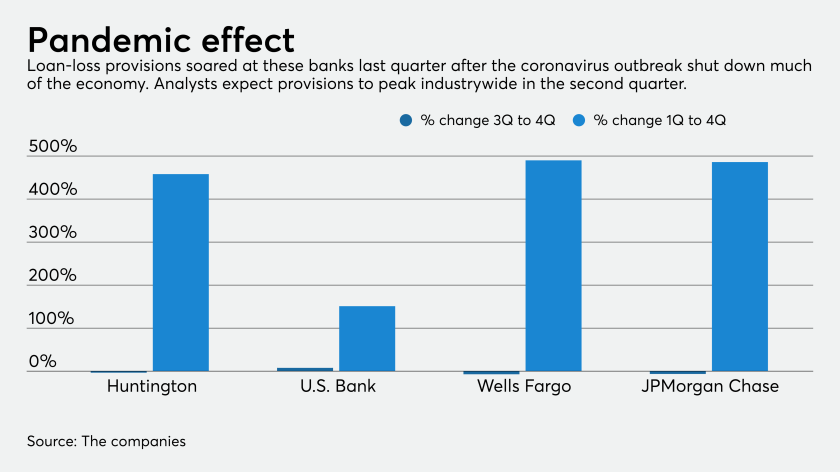

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

The institute released guidance on how to account for forgivable loans under the Small Business Administration’s Paycheck Protection Program.