The company's Silicon Valley Bank unit reduced its loan-loss cushion by $52 million. Private-equity and VC clients have warmed to the practice of doing deals virtually, which increases lending opportunities, SVB executives said.

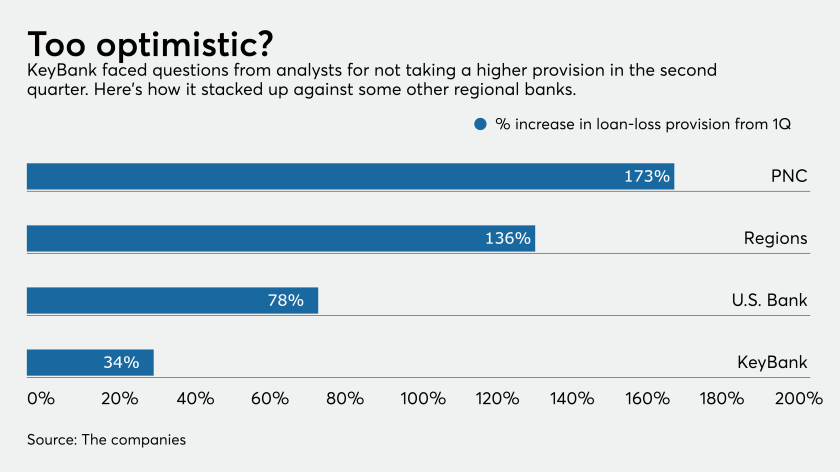

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

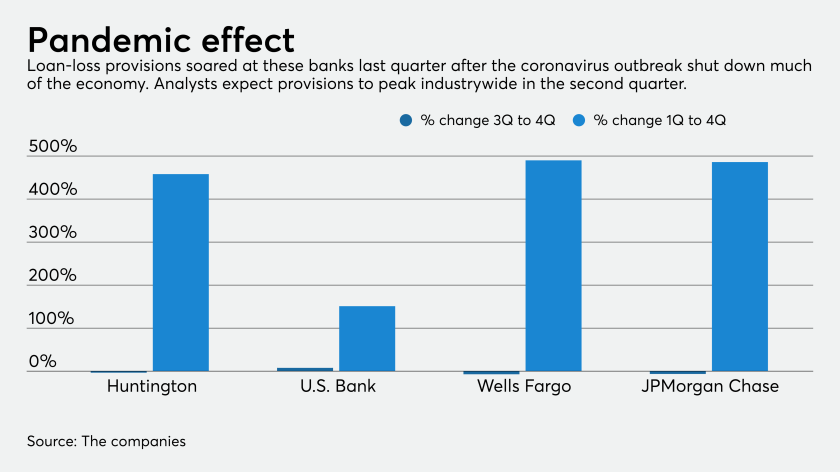

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

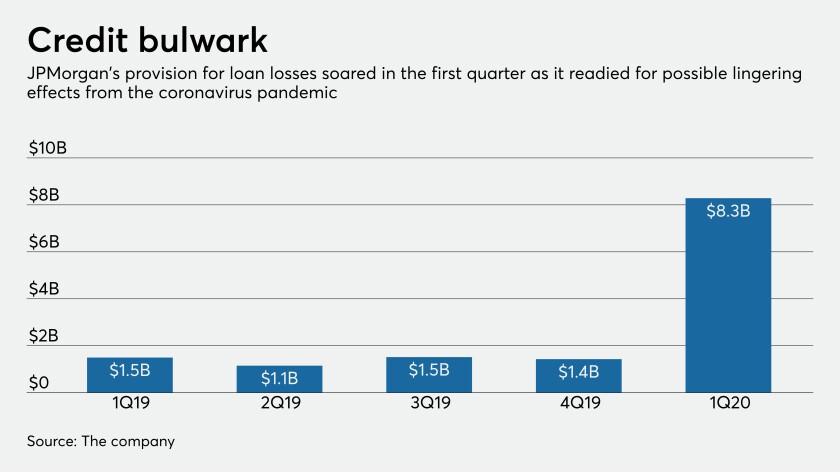

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

The $2.2 trillion package passed by the Senate includes a provision that would allow banks the temporary option to postpone compliance with the credit losses standard.

The Financial Accounting Standards Board has come under pressure to relax its credit losses standard as banks and other financial institutions see the value of their assets plunging from the sell-off in the capital markets amid the coronavirus pandemic.