- 3 Min Read

In the current economic environment, it could be advantageous for you or your clients to consider a strategic acquisition.

4 Min ReadExecutives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

3 Min ReadBetween the pandemic, aging CPA firm owners and staffing tensions, many in the accounting profession anticipate a huge uptick in firm mergers and acquisitions over the next 24 months.

5 Min ReadIf the mega payments deals of 2019 left the acquiring landscape somewhat scorched, the COVID-19 pandemic planted new seeds to allow ISOs to grow by quickly converting merchants to electronic payments.

7 Min ReadThe Federal Reserve could ease capital rules, foster the creation of special-purpose banks and take other steps to strengthen minority communities and businesses without legislation being sought in Congress — if it has the will to do so, experts say.

2 Min ReadJust eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

3 Min ReadPayment processor Elavon purchased Sage Pay four months ago, completing the acquisition on March 11. Two days later, Elavon's entire workforce was operating remotely as the coronavirus forced it into lockdown.

5 Min ReadThe major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

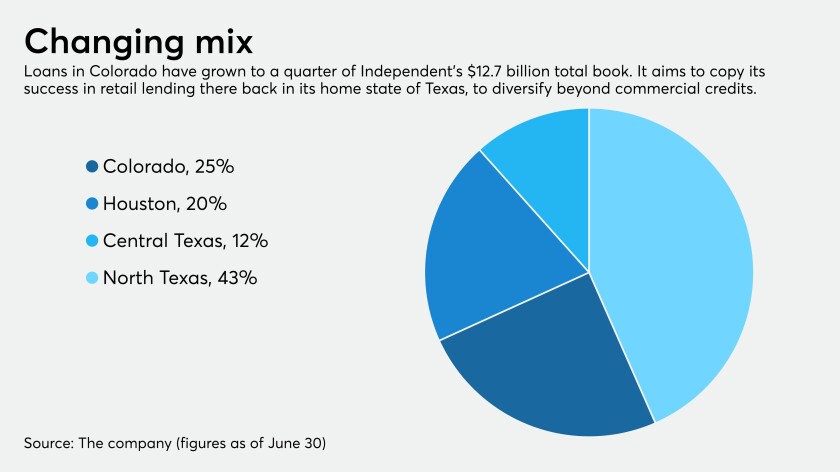

3 Min ReadNow that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

5 Min ReadNow perhaps more than ever, banks and their proxies need to show tact when communicating with past-due borrowers.

6 Min ReadThe COVID-19 pandemic isn’t stopping BDO USA from pursuing a constant series of M&A deals in recent years, although the latest one had to be mostly negotiated at a safe distance.

1 Min ReadIt’s a good time to be opportunistic about your firm’s future — and to poke these embers in a meaningful way.

1 Min ReadThe pandemic may not be changing the M&A landscape in the ways you expect, says Transition Advisors' Joel Sinkin as he dives into what's different, and how.

12 Min ReadThe CARES Act included several provisions allowing companies to claim net operating losses for past tax years, temporarily reversing some of the limitations in the Tax Cuts and Jobs Act.

1 Min ReadThe pandemic is prompting financial advisors to use video messages, webinars and even board games to connect with clients and prospects, Hightower Chief Marketing Officer Abby Salameh says in an episode of Financial Planning’s Podcast.

4 Min ReadThe coronavirus pandemic has made paper money literally a dirty word, causing a rush to digital payments that may be too fast for Western Union and MoneyGram to keep up with as separate companies.

4 Min ReadBanks would be wise to dust off their Great Recession playbook and shed nonperforming loans while growing through M&A.

4 Min ReadThe $43 billion deal was one of a series of payment mergers in 2019 that were designed to combine bank technology and merchant acquiring across multiple markets and industries while warding off ascendant fintechs offering fast access to digital payments and working capital.

4 Min ReadThe Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

4 Min ReadWhen Fiserv purchased First Data in 2019, it was part of an industrywide push to combine bank and merchant technology under one roof. A year later, a key piece of First Data’s technology — and its top executive — have become Fiserv’s path through the coronavirus crisis.