Many of the Buffalo, N.Y., bank’s commercial loans have exited forbearance granted in the early days of the pandemic — except hospitality and retail, which were given longer dispensation.

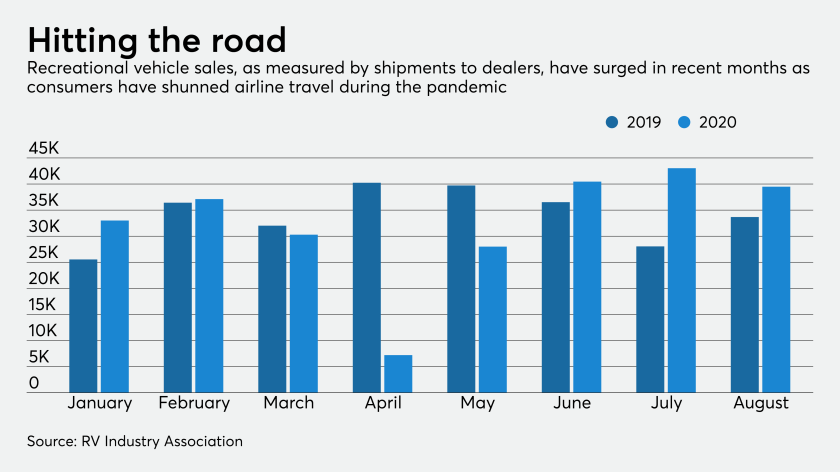

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

Several companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

The performance of about $3 billion in hotel and other loans flagged by the Dallas company as high-risk has been a "a pleasant surprise," its chief credit officer said at an industry conference.

The move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

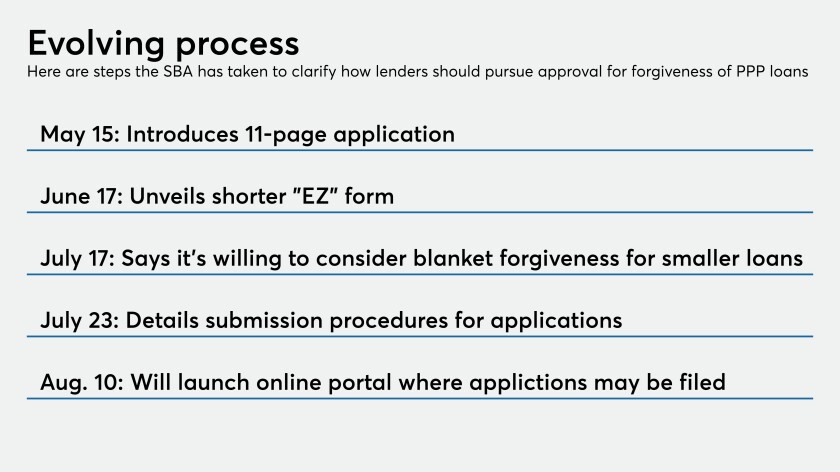

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

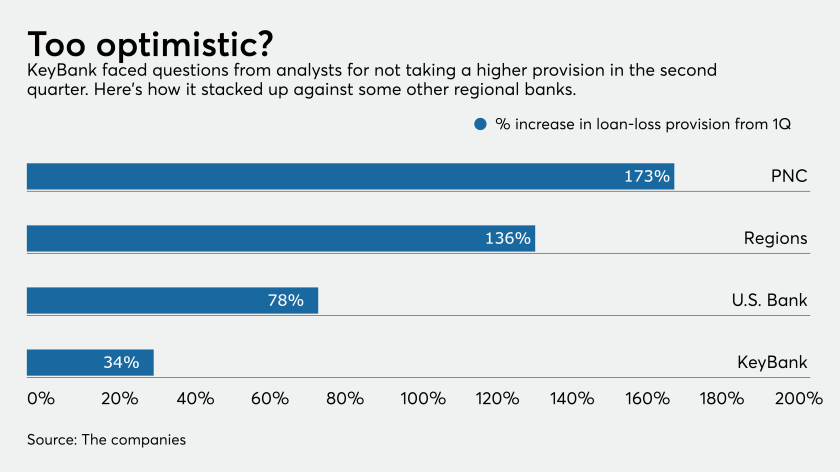

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.