Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

Bill Smith, managing director of the National Tax Office of CBIZ MHM, discusses the loan forgiveness provisions of the PPP, along with the employee retention credit, net operating loss carrybacks and economic impact payments, along with the prospects for the next round of stimulus in Washington.

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

The House voted Thursday to give small businesses financially strapped by the COVID-19 crisis more flexibility to spend forgivable loans for payrolls and expenses from the government’s popular Paycheck Protection Program.

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

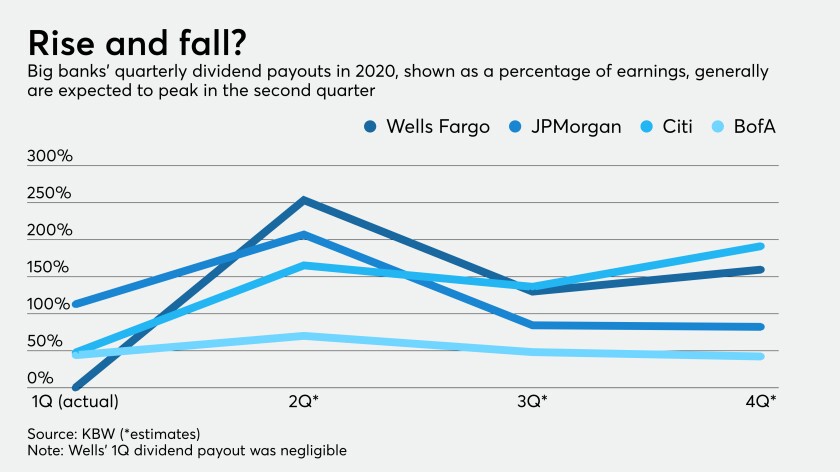

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

The lines of white cooling trailers that silently announce the scale of the tragedy are what lockbox employees at JPMorgan Chase see on their way to work.

The SBA’s form clarifies some issues, but still leaves questions to be answered.

American Express began adopting cloud computing a couple of years ago and has leaned hard on the technology to help front-line and corporate employees work at home during the coronavirus crisis, its global head of infrastructure says.