We just got through a most unusual “tax season,” with taxes pushed aside at the beginning of April to be consumed with the SBA and PPP.

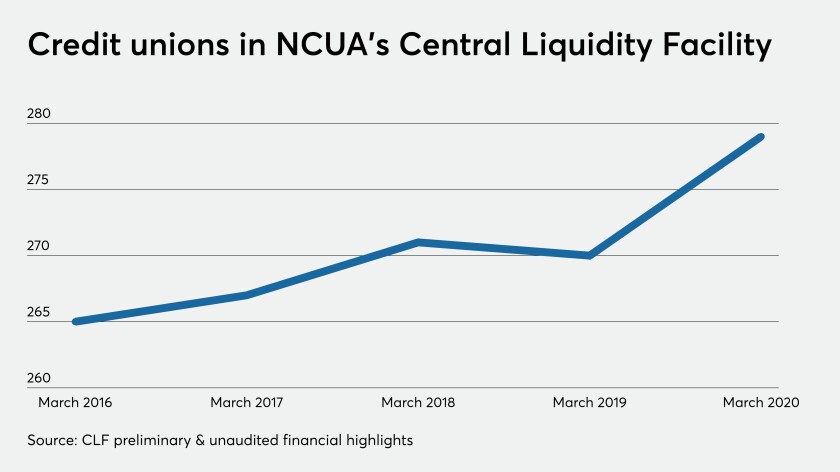

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

The service says it won't be able to provide protective equipment immediately.

The bureau said it began developing the standards before the coronavirus pandemic. But more transfers may occur as some servicers struggle to meet their obligations during the economic downturn.

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

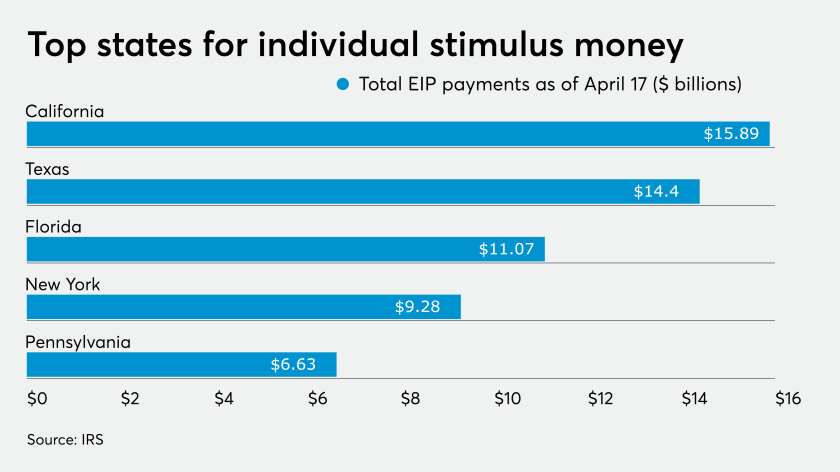

The IRS announced it has delivered 88 million Economic Impact Payments as of April 17, 2020.

Payroll giant Paychex is partnering with Biz2Credit, Fundera and Lendio to help small businesses apply for the new funding offered by the U.S. Small Business Administration’s Paycheck Protection Program.

The state's tough budget position was underscored by an agreement with noteholders to extend a $750 million maturity while paying them higher interest.

"We're now in a different world," Stephen Squeri, chairman and CEO of Amex, said during the card brand's first-quarter earnings call.

Treasury Secretary Steven Mnuchin says the additional funding Congress approved Thursday to help small businesses survive the coronavirus pandemic should be the last round, but advocates fear it’ll run out quickly and won’t be enough for mom-and-pop shops struggling to stay open.