More than half of employees report feeling lonely while working from home, which impacts productivity, job performance and retention.

The American Institute of CPAs has joined with over 560 business and trade organizations in urging Congress to pass legislation.

The slowest month of job growth since the spring occurred amid the ravages of the COVID-19 pandemic.

There are signs of a slowdown in the economy as businesses continue to struggle with rising COVID-19 infections across the country.

Economic experts believe the current surge is not enough to stop continued losses incurred by various segments of economy.

With a CARES Act fix stalled along with stimulus legislation, the institute is urging CPAs to put pressure on their representatives.

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.

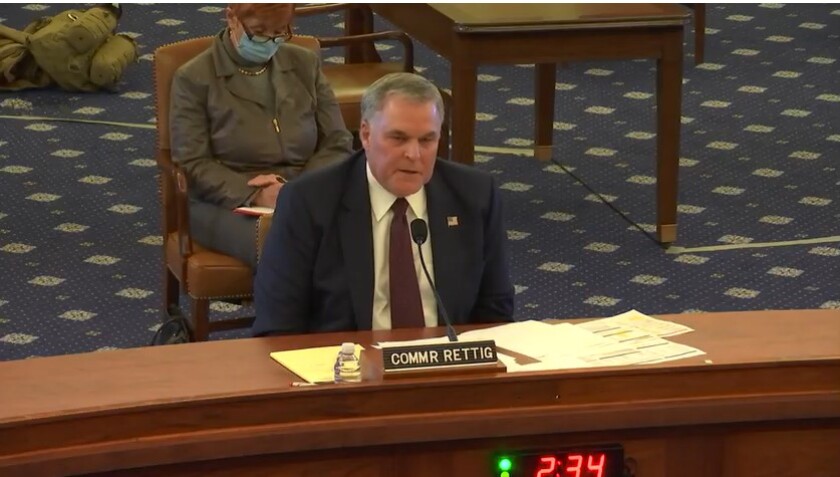

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

The top Republican and Democrat on the Senate Finance Committee said the Treasury Department “missed the mark” in new guidance that limits tax breaks for businesses that get their Paycheck Protection Program loans forgiven.

The Internal Revenue Service reminded taxpayers Thursday that they only have until Nov. 21 at 3 p.m. Eastern Time to register for an Economic Impact Payment of $1,200 or more.