The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.

The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

The single-family house on Forestview Avenue in Euclid, Ohio, a suburb of Cleveland, shows no signs of farming activity. The only things growing on the one-eighth-acre plot are trees, shrubs and grass.

The institute released the pair of reports as companies increasingly rely on their CFOs and accounting departments to help them survive beyond the coronavirus pandemic.

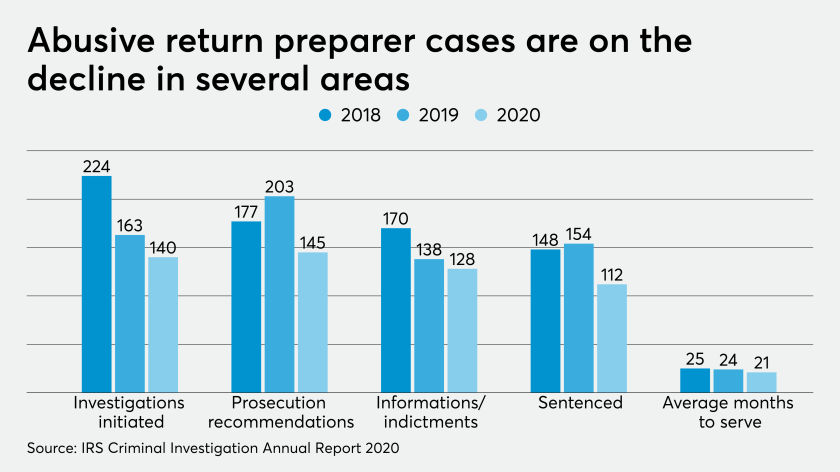

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

The Governmental Accounting Standards Board is giving state and local governments extra time to implement its new leases standard because of the coronavirus pandemic, and they will need it.

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

The service is rolling out new systems and expanding forms that can be electronically filed by tax-exempt organizations.

With the presidential election now decided, managers can model empathy and boundary setting to get employees back on track and refocused at work.

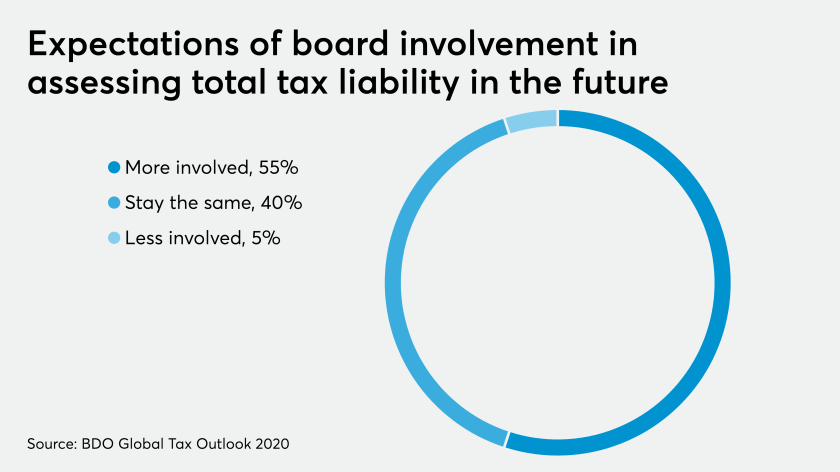

Eighty percent of the business leaders surveyed by BDO in the Americas said the focus of tax legislation changes constantly as the result of the elected party and/or it is difficult to predict.